Bitcoin has been experiencing some volatility over at the moment’s buying and selling session as the worth of BTC touches vital resistance ranges. The primary crypto by market cap positively reacted to macroeconomic elements, however because the weekend approaches, low ranges would possibly result in sudden value motion.

On the time of writing, Bitcoin (BTC) trades at $19,800 with a 1% revenue within the final 24 hours and an 8% loss over the previous week. The cryptocurrency noticed bullish value motion after the U.S. posted essential metrics about their financial system, however the rally was brief lived as BTC stumble beneath a cluster of promoting orders at round $20,400.

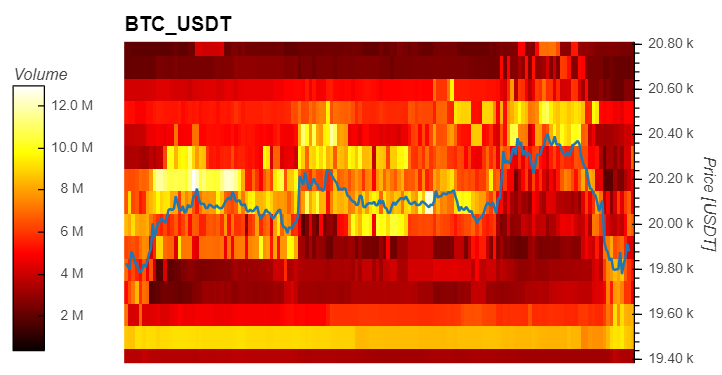

Information from Materials Indicators exhibits how the liquidity within the Binance order books has been following the worth of Bitcoin. Massive gamers have been setting purchase and promote orders as BTC approaches vital ranges.

As seen within the chart beneath, at the moment’s rejection was triggered by a stack of round $20 million in asks orders as Bitcoin trended to the upside. The worth has seen an analogous sample throughout this week with BTC’s value trending upwards solely to expertise overhead resistance triggered by a spike in ask liquidity.

On the other way, purchase (bid) orders have remained comparatively extra steady with $19,500, $19,000, and $18,000 displaying essentially the most liquidity. These ranges shall be vital as they may function as help and forestall BTC’s value from reaching a brand new yearly low if the market makes an attempt to pattern decrease.

In that sense, Materials Indicators additionally present a rise in promoting stress from massive gamers. Asks orders of over $100,000 and $1 million have been rising on decrease timeframes and will function as a short-term hurdle for any potential upside.

Within the U.S., the weekend shall be prolonged till Tuesday attributable to a vacation. This usually results in spikes in volatility as low quantity affect the worth motion.

What May Play In Favor Of Bitcoin?

Further knowledge offered by analyst Justin Bennett signifies a possible rejection of the U.S. greenback because the forex makes an attempt to interrupt above an essential flat base. This might result in reclaim of ranges final seen in 2003.

Nonetheless, the forex has been unable to clear the world above 109, as measured by the DXY Index, and a “fakeout” is likely to be in play. Bitcoin and the crypto market have been negatively correlated with the U.S. greenback. Due to this fact, a rejection would possibly play in favor of the nascent asset class. Bennett said:

To date, it seems just like the $DXY was “incorrect”. Perhaps a pullback to 107 subsequent week if this pattern line breaks. That might be bullish for crypto within the brief time period. However finally, I feel the USD index heads to 112-113 and possibly even greater.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)