On-chain information reveals the quantity of Bitcoin provide in loss has now reached ranges much like through the COVID crash and the 2018 bear market backside.

Bitcoin Provide In Loss Spikes Up Following The Newest Crash

As identified by an analyst in a CryptoQuant post, the BTC provide in loss has set a brand new file for this yr following the FTX catastrophe.

The “provide in loss” is an indicator that measures the entire quantity of Bitcoin that’s at the moment being held at some loss.

This metric works by trying on the on-chain historical past of every coin within the circulating provide to see what worth it was final moved at.

If this earlier worth for any coin was greater than the present BTC worth, then that individual coin is in some unrealized loss proper now, and the indicator accounts for it.

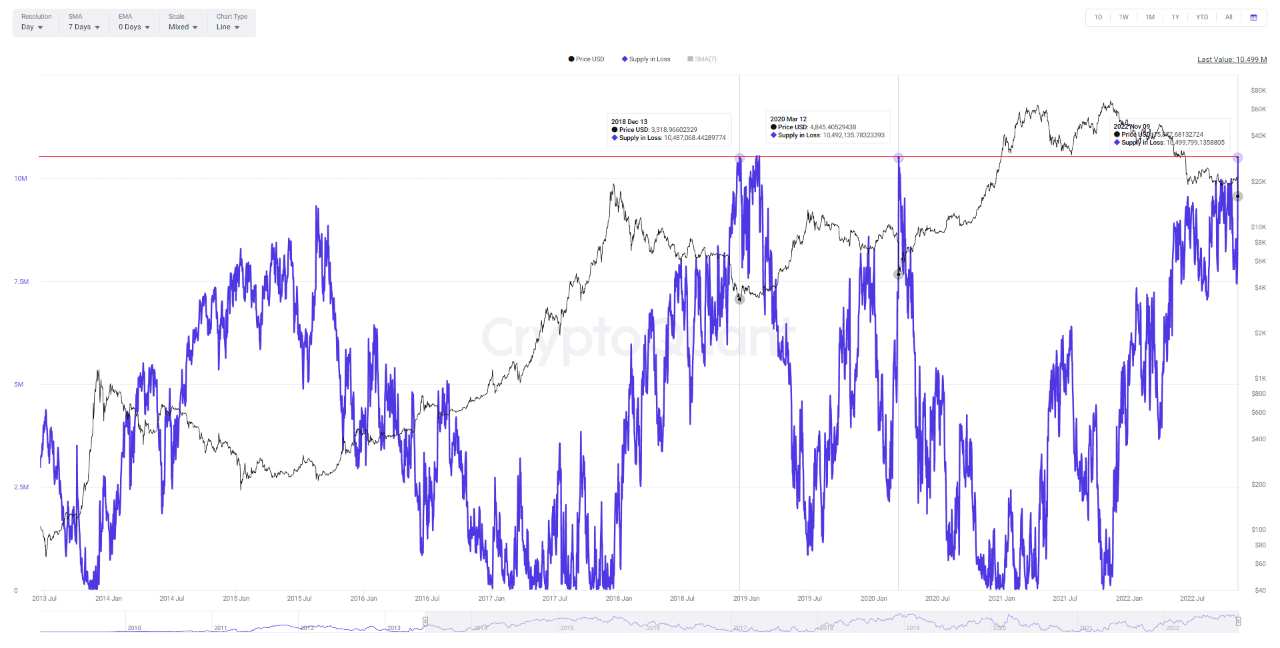

Now, here’s a chart that reveals the pattern within the 7-day transferring common Bitcoin provide in loss over the historical past of the crypto:

The 7-day MA worth of the metric appears to have been fairly excessive in current days | Supply: CryptoQuant

As you possibly can see within the above graph, the Bitcoin provide in loss has sharply risen up during the last couple of days as the worth of the crypto has noticed a deep crash.

The present loss worth is a brand new file for the 2022 bear market, and can be in actual fact the best the indicator has been because the COVID black swan occasion again in 2020.

Notably, the quantity of underwater provide available in the market was additionally at related ranges again in late 2018, when the bear market of that cycle set its backside.

If the identical pattern as in these earlier bottoms follows now as effectively, then the most recent excessive loss values could suggest the market has now declined deep sufficient for a backside.

Nonetheless, even when the sample does comply with, it doesn’t imply ache may be over for the buyers. As is obvious from the chart, within the 2018-19 bear the market moved principally sideways after the underside, and likewise fashioned one other peak of comparable loss values, earlier than some bullish wind returned to Bitcoin.

BTC Value

On the time of writing, Bitcoin’s worth floats round $16.4k, down 18% within the final week. Over the previous month, the crypto has misplaced 15% in worth.

The under chart reveals the pattern within the worth of the coin during the last 5 days.

Seems like the worth of the crypto has recovered a bit because the crash under $16k | Supply: BTCUSD on TradingView

Featured picture from Jonathan Borba on Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)