Following robust weekly double-digit beneficial properties from Bitcoin and quite a lot of big-cap altcoins, the cryptocurrency market capitalization surpassed $1 trillion.

$1 Trillion Market Crossed Once more

For the primary time since June 13, a big acquire on Monday in each bitcoin and ether helped raise the market value of cryptocurrencies again past the $1 trillion degree.

The most important cryptocurrency has reached its highest costs since a selloff in mid-June introduced the worth of bitcoin down from $30,000 to as little as $18,000, rising 5% within the final 24 hours to $22,300.

In the course of the late 2017 bull market surge for bitcoin, that very same degree served as a powerful area of resistance, and in technical evaluation, outdated resistance sometimes turns into new assist (and vice versa).

Crypto market cap above $1 trillion threshold. Supply: TradingView

For cryptocurrency traders, Monday’s income ought to come as a aid after the previous 9 months have seen them endure a horrible bear market. Because of the extended bear market in cryptocurrencies, $2 trillion in market worth has been misplaced, and a number of other crypto firms, together with Celsius, Voyager Digital, and Three Arrows Capital, have gone bankrupt.

Regardless of analyst predictions that the Federal Reserve would enhance rates of interest by at the least 75 foundation factors on the Federal Open Market Committee assembly on July 27, the normal markets are mildly larger on the day that cryptocurrencies are typically within the black.

Whereas merchants might just like the uptick in worth on July 18, a number of analysts warn that it’s merely a bear market pump.

Associated Studying | Bitcoin Bearish Sign: Change Netflows Spike Up

Bitcoin Poised For Rebound

In accordance with TradingView information, Bitcoin has made appreciable beneficial properties over the previous week. On the time of writing, BTC had risen by 16 p.c from its most up-to-date low of $18,907.

Probably the most useful cryptocurrency is presently bumping up into resistance on the 200-week transferring common, which additionally occurs to be the highest of the buying and selling vary that BTC has been caught in for the reason that center of June.

Over the previous 5 weeks, makes an attempt to interrupt above this degree have been repeatedly rejected, proving it to be a tough nut to crack. It’s but unclear whether or not Bitcoin will have the ability to overcome this barrier and climb larger or if it’s going to proceed to fluctuate between $19,000 and $22,000.

$BTC battling that 200 Week MA once more. Rejected 3 instances within the final 5 weeks right here.

Resolution time imo.

We both have a fats breakout or fats breakdown. $ETH has been main the market to date, together with many different altcoins. Breakouts occurring all over the place.

Can $BTC comply with swimsuit? pic.twitter.com/6Cz49po8CH

— Taner ⚡️ (@Taner_Crypto) July 18, 2022

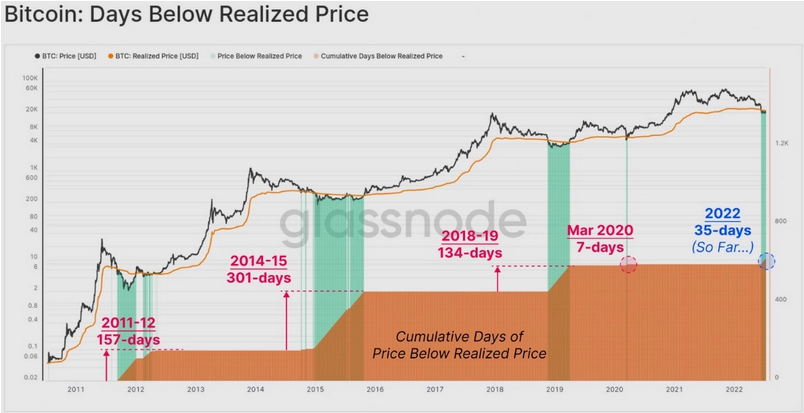

The key distinction between the current bear market and former cycles, in line with Glassnode’s most up-to-date publication, is “length” and lots of on-chain measures at the moment are comparable to those historic drawdowns.

Realized worth, which is calculated as the worth of all Bitcoin divided by the amount of BTC in circulation, has proven to be indicator of bear market bottoms.

Variety of days Bitcoin worth traded under the realized worth. Supply: Glassnode

Excluding the flash crash in March 2020, which is depicted on the above chart, Bitcoin has constantly traded under its realized worth for a protracted time period all through bear markets.

Glassnode defined:

“The common time spent under the Realized Value is 197-days, in comparison with the present market with simply 35-days on the clock.”

Associated Studying | Bitcoin Breaks Above Realized Value Once more, Backside Lastly In?

Featured picture from Getty Photographs, charts from TradingView.com

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)