On-chain information reveals the Bitcoin NUPL metric at present has values that will counsel the bear market is but to hit in full swing, if the coin is in a single.

Bitcoin NUPL Worth Nonetheless Not As Low As Earlier Bear Markets

As identified by an analyst in a CryptoQuant post, the BTC NUPL metric suggests market hasn’t neared a bear market backside but.

The “web unrealized profile/loss” (or NUPL in brief) is an indicator that tells us concerning the ratio of revenue and loss within the Bitcoin market.

The metric’s worth is calculated by taking the distinction between the market cap and the realized cap, and dividing it by the market cap.

When the NUPL has a worth larger than zero, it means there are extra cash in revenue than ones in loss in the intervening time.

However, destructive values of the indicator suggest that buyers are, on common, in a state of loss proper now.

Associated Studying | Bitcoin Bullish Sign: Alternate Reserve Loses One other 50k BTC Over Previous Week

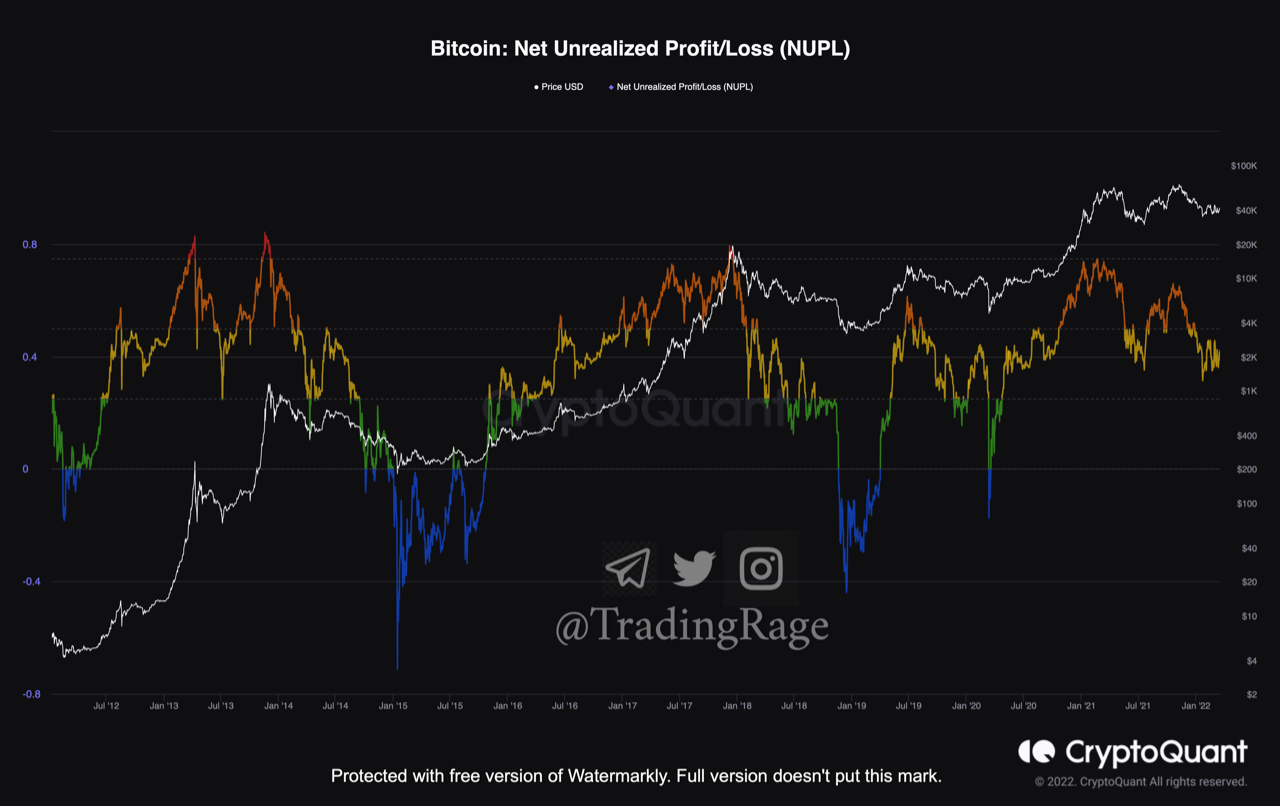

Now, here’s a chart that reveals the pattern within the Bitcoin NUPL over the historical past of the crypto:

Seems like the worth of the indicator continues to be above zero | Supply: CryptoQuant

As you may see within the above graph, the Bitcoin NUPL metric has typically been in a position to predict high and backside formations by its numerous coloured zones.

Within the earlier bear markets, the indicator’s worth has normally fallen off under zero (blue) as a backside approached.

Within the lead as much as these bearish intervals have been the yellow and inexperienced phases, however at present the NUPL nonetheless appears to be like to be within the yellow zone.

This may increasingly imply that if Bitcoin has already entered right into a bear market, it has nonetheless some methods to go earlier than whole capitulation and backside formation.

Associated Studying | What’s Bitcoin Position After Finish of Petrodollar System? Arthur Hayes Says

Nonetheless, it’s price noting that there have been cases earlier than the place the indicator dropped into the yellow zone after a bull rally, however then jumped again up quickly after because the bullish pattern continued, indicating a mid-cycle backside formation as a substitute.

The newest instance of this was throughout the mini-bear interval of Might-July 2021, the place the coin bottomed at round $28k and rallied on to a brand new ATH.

BTC Value

On the time of writing, Bitcoin’s worth floats round $41.4k, up 6% prior to now week. During the last month, the crypto has gained 8% in worth.

The under chart reveals the pattern within the worth of the coin over the previous 5 days.

The value of the crypto appears to have held above $40k over the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)