After the official US inflation numbers have been launched, bitcoin costs began to rise. Nevertheless, through the earlier month, the BTC miners have elevated their outflow.

A brand new set of tax insurance policies focused at stopping home cryptocurrency mining have been unveiled by Kazakhstan, which remains to be a big nation on the earth of Bitcoin mining.

Throughout a halt in worldwide exercise and hearth gross sales related to current bankruptcy-related information, costs for Bitcoin mining rigs are additionally stated to have fallen to epidemic lows for 2020.

Most importantly, Texas energy grid operators have requested all Bitcoin miners to stop operations with the intention to reduce the pressure on an influence grid that’s already overloaded.

Bitcoin Miners Influx Attain New ATH

IT Tech experiences that Bitcoin miners transferred over 14,000 BTC to an trade in a single block. The switch from the miner pockets to the trade was famous as being unfavorable for the market. In response to their definition of mining pool wallets of their stats, all pool members—together with the precise miner—are included.

One person did level out that these Bitcoin weren’t mirrored within the spot market or derivatives, although. Glassnode reported that the BTC Miners’ Netflow Quantity on a 7-day transferring common (MA) foundation hit an all-time excessive (ATH) of $1,779,953. Within the first week of January 2022, an ATH of $1,700,940 was registered.

This outflow didn’t cease on the trade pockets, in line with Ki Younger Ju, CEO of CryptoQuant. It’s going to most likely find yourself in a custodial chilly pockets. This may be utilized as an OTC deal or as a custodial service. In his opinion, the information is both bullish or impartial.

Miner simply moved 14k $BTC:

Poolin individuals → Unknown pocketsIt didn’t go to an trade pockets however extra like a custodial chilly pockets. It might be for utilizing a custodian service or an OTC deal. It’s impartial or bullish information.

Good catch @IT_Tech_PL https://t.co/G25DsK2nR6 https://t.co/rYmqVaoTAR

— Ki Younger Ju (@ki_young_ju) July 15, 2022

Associated Studying | Mid Cap Crypto Cash Lead In July, Greatest Means To Climate The Winter?

Worth Might Surge?

Moreover, open curiosity is rising, in line with IT Tech, and the market might quickly expertise progress. The Bitcoin miner reserves have decreased over the last two weeks, in line with the examine. This, nevertheless, could also be a big signal of waning confidence in a worth turnaround.

Inside the previous 24 hours, the value of bitcoin has elevated by greater than 6%. BTC is presently buying and selling for $20,953 on common. Its 24 hour buying and selling quantity is up by 2% to face at $32.8 billion.

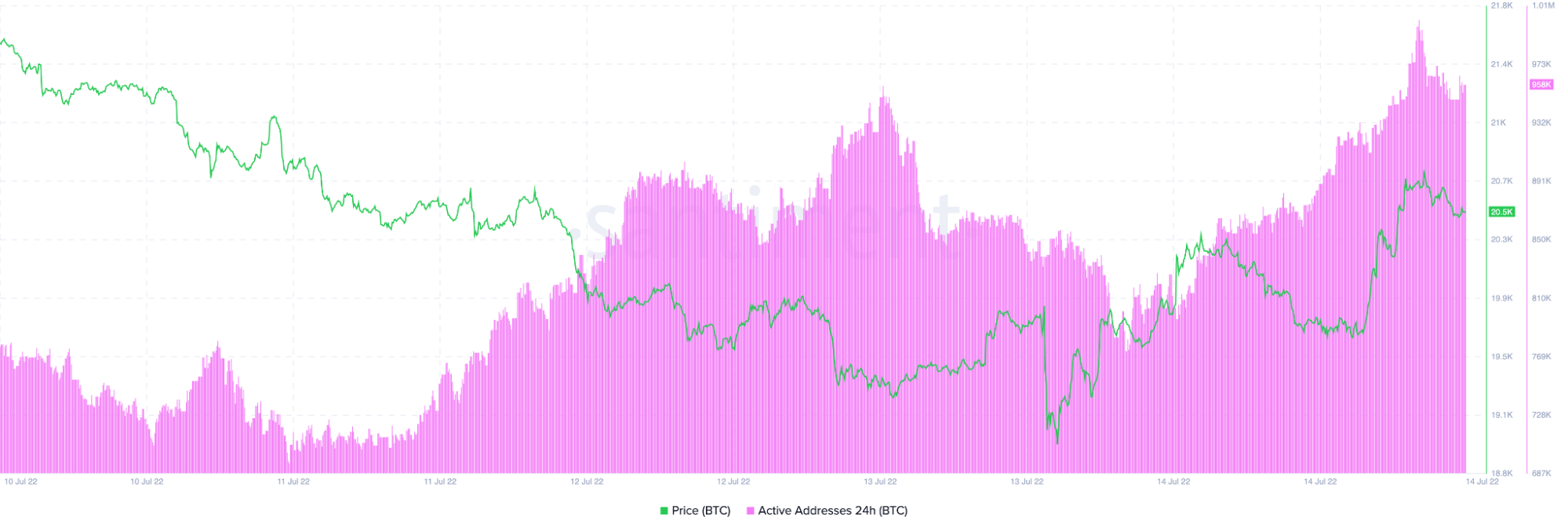

BTC energetic addresses have grown through the previous 24 hours, says Santiment. The quantity was near one million at press time, in comparison with 860,000 on July 14. This demonstrates that investor temper is rapidly bettering.

Supply: Santiment

The quantity, which modified from 28.13 billion to 31.64 billion, is in a comparable state of affairs. For Bitcoin maximalists, the rise in worth over the previous 24 hours on July 15 could also be an indication of reduction. In actuality, on the time of writing, Bitcoin’s market cap has elevated from $376 billion to $395 billion.

BTC market cap surges. Supply: TradingView

Within the meantime, Anthony Pompliano stated in his evaluation that the value of bitcoin is declining as a consequence of rising inflation. It could be correct, he continued, that it’s not a powerful hedge towards CPI.

Associated Studying | Bitcoin Worth Spends 4 Weeks At 2017 Peak Costs, What Comes Subsequent?

Featured picture from Pixabay, charts from TradingView.com and Santiment

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)