Knowledge reveals the Bitcoin long-term holder provide has climbed again up and set a brand new all-time excessive, suggesting that conviction could also be returning out there.

Bitcoin Lengthy-Time period Holder Provide Recovers From FTX Panic Promoting

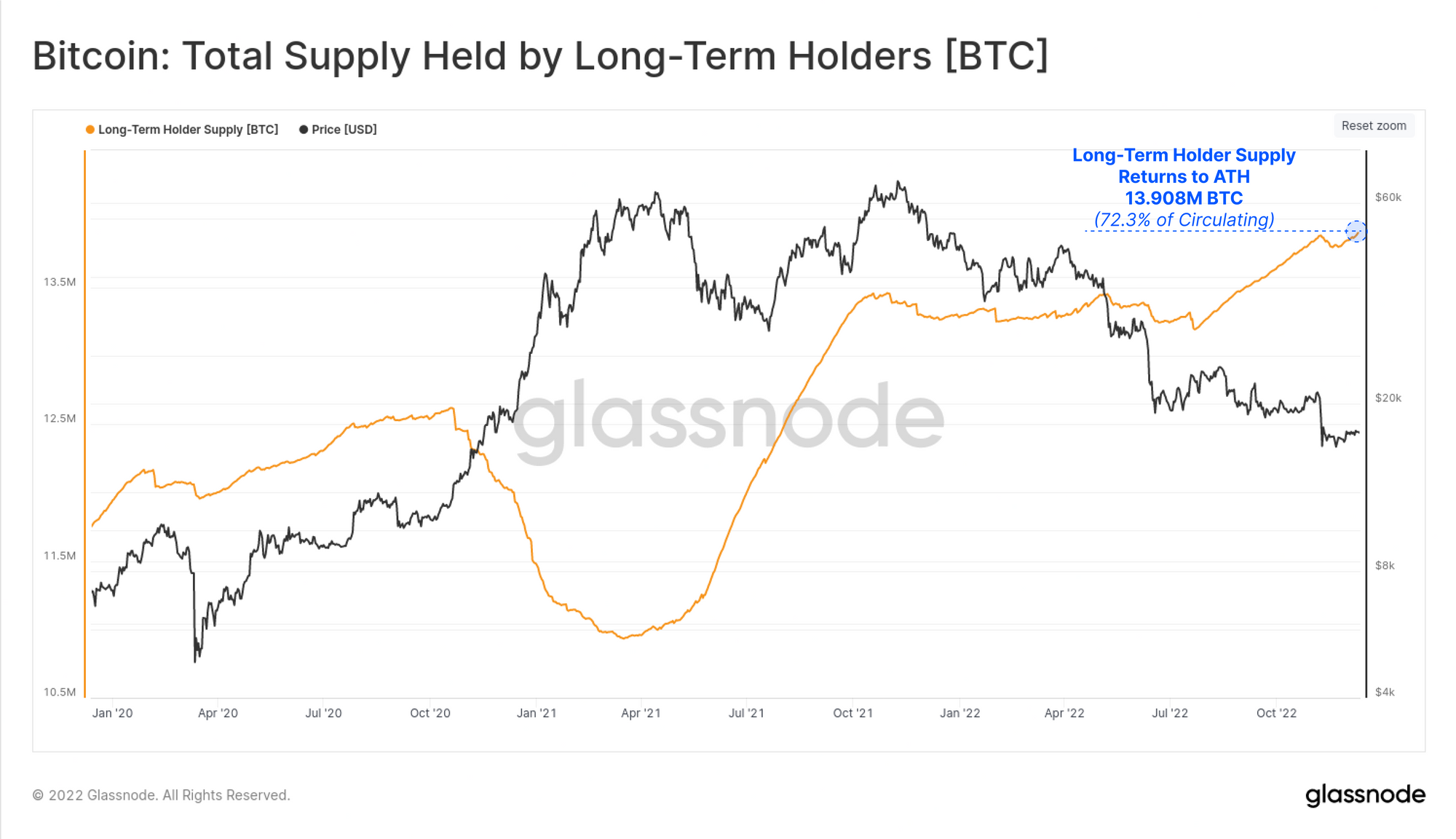

Based on the newest weekly report from Glassnode, BTC long-term holders now maintain round 72.3% of the full circulating provide. The “long-term holder” (LTH) group is likely one of the two main cohorts within the Bitcoin market and contains all traders who’ve been holding onto their cash for at the least 155 days in the past, with out having moved or offered them from their pockets.

Associated Studying: Bitcoin NVT Golden Cross Nonetheless In “Overbought” Area, Volatility To Observe?

“Quick-term holders” (STHs) make up the opposite aspect of the market. Statistically, the longer traders maintain their cash, the much less possible they turn out to be to promote at any level. Subsequently, LTHs are the extra resolute group of the 2 and are generally dubbed the “diamond arms” of the market.

The “LTH provide” is an indicator that measures the full quantity of BTC that these HODLers as a complete are presently carrying of their wallets. Here’s a chart that reveals the pattern on this metric over the previous couple of years:

Appears like the worth of this metric has seen a rise in current days | Supply: Glassnode's The Week Onchain - Week 50, 2022

Because the above graph reveals, the Bitcoin LTHs displayed a powerful accumulation pattern between July and early November, inflicting their provide to succeed in a brand new peak. Nonetheless, the crash because of the collapse of the crypto change FTX utterly reversed the pattern as these holders rapidly began shedding off their holdings as a substitute.

This decline within the indicator means that the crash made even these resolute holders panic and unload their cash. However in the previous couple of weeks, tides have as soon as once more appeared to have shifted. Because the market has traded sideways, the LTH provide has noticed a relentless rise, implying that these traders are again at accumulating.

The metric has now absolutely retraced the drawdown because of the FTX debacle and has set a brand new all-time excessive of 13.9 million BTC, equivalent to about 72.3% of the full circulating provide.

The 155-day threshold would put the supply of this new streak of accumulation again in June and July of this yr, which is when the deleveraging occasion because of the 3AC collapse came about.

This new rise within the LTH provide means the conviction is returning amongst these Bitcoin HODLers, one thing that has traditionally been bullish for the value in the long run.

BTC appears to have bounced again from yesterday's fall | Supply: BTCUSD on TradingView

On the time of writing, Bitcoin’s worth is buying and selling round $17.2k, up 1% within the final week.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)