Bitcoin value holds above $28,000 as merchants speculate whether or not extra upside momentum nonetheless exists. Buyers are awaiting the essential charge hike determination by the U.S. Federal Reserve after the FOMC assembly on Wednesday amid the banking disaster within the U.S.

The CME FedWatch Tool signifies there’s an 18.1% chance of no charge hike by the Fed and an 81.9% chance for a 25 bps charge hike. Furthermore, the Crypto Fear & Greed Index has hit a 16-month excessive of 68, with the market sentiment at the moment within the ‘Greed‘ zone.

Bitcoin Fundamentals Shifting Forward of FOMC

Large Bitcoin rally within the final two weeks pushed BTC value to hit over $28,000 after 9 months. Nonetheless, the basics are altering forward of the FOMC charge hike determination.

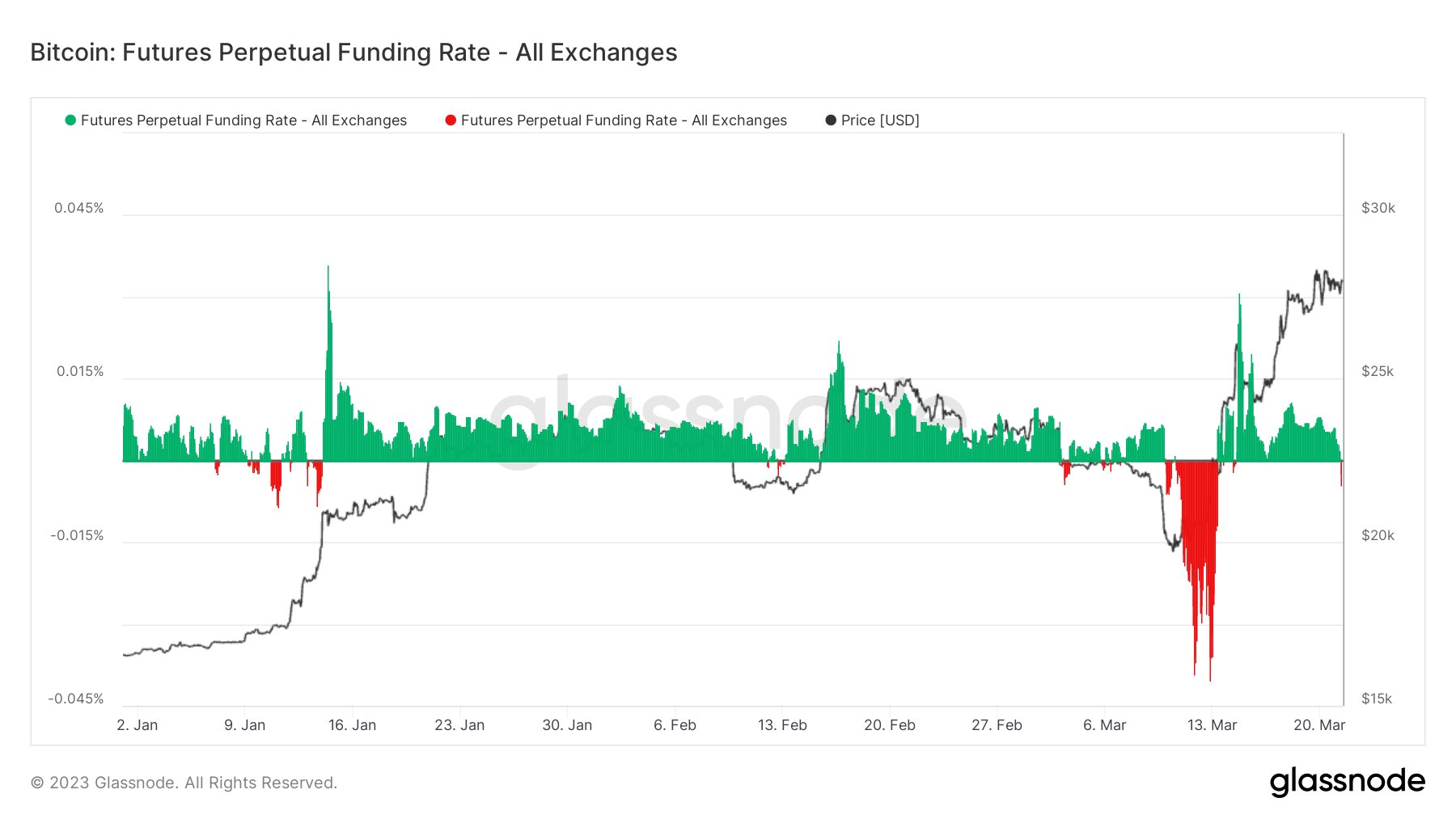

Bitcoin futures perpetual funding charge simply turned unfavourable for the primary time in every week as merchants speculate whether or not a correction is coming subsequent. Bearish sentiment forward of the essential FOMC charge hike will probably trigger Bitcoin value to fall under $27,000 once more.

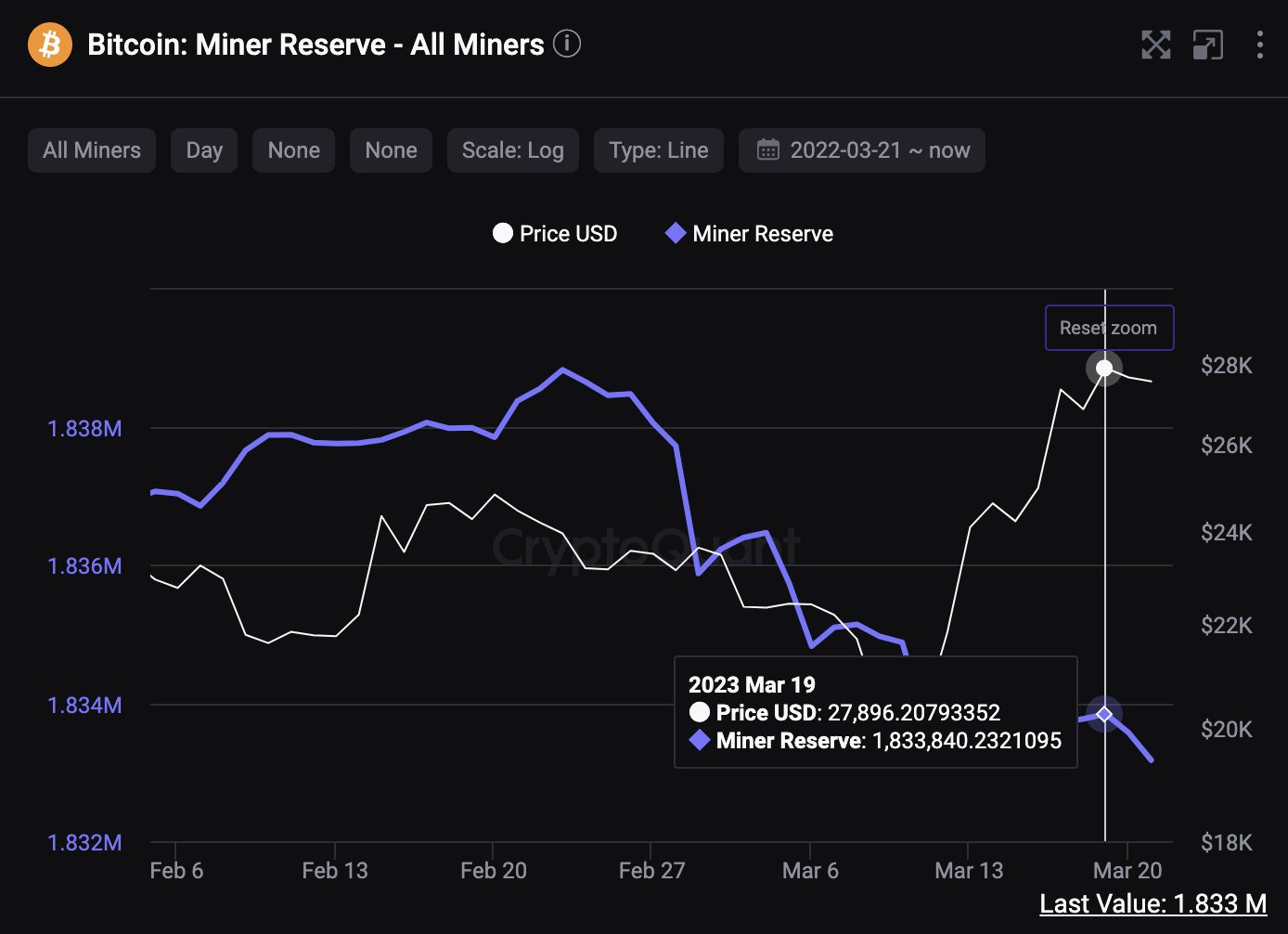

In the meantime, the dump on BTC dominance is making a spike in altcoins, with Ethereum and XRP leaping 3% and 5% in simply an hour, respectively. Furthermore, miner reserves dropped by 668 BTC within the final 48 hours, which means that miners have bought round $18,370,000 value of BTC.

Wall Road Estimates On Fed Charge Hike

Tesla CEO Elon Musk, economist Peter Schiff, and billionaire Invoice Ackman have warned the U.S. Fed and FDIC of worsening banking disaster and market situations if the central financial institution decides to proceed charge hikes. Invoice Ackman believes the Fed ought to pause, whereas Elon Musk replied “Fed must drop the speed by no less than 50bps on Wednesday.”

For the primary time in a few years, Wall Road giants have given combined estimates on the Fed charge hike. Barclays, Credit score Suisse, and Goldman Sachs not anticipate the Fed to hike charges in March. In the meantime, Bloomberg, JP Morgan, Morgan Stanley, BMO, and Citi estimate a 25 bps charge hike.

Additionally Learn: LUNC Information: Developer Edward Kim Hints At Terra Luna Basic Turning into AI Chain

The introduced content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)