Bitcoin has been transferring sideways round its present ranges with no clear course on decrease timeframes. The cryptocurrency has skilled its worst-selling stress in years however has held firmly round its 2017 all-time excessive.

Associated Studying | Crypto Buying and selling Volumes In India Sink Due To Heavy Taxation, What’s Forward?

On the time of writing, Bitcoin trades at $20,140 with a 4% revenue within the final 24 hours. The final sentiment available in the market has been turning extra constructive, as NewsBTC reported yesterday, because the Crypto Concern and Greed Index climbs again from Excessive Concern ranges.

In line with Senior Commodity Strategist Mike McGlone, Bitcoin and the crypto market are close to their 2018 drawdown ranges. At the moment, the nascent asset class skilled an analogous bearish pattern which pushed BTC’s value to a 75% loss from its ATH.

At the moment, the $3,000 value level turned a significant backside which noticed a interval of accumulation extending for a number of years. In 2020, when international markets have been in turmoil because of the COVID-19 pandemic, BTC marked the underside as soon as extra when close to $3,000.

After that, the cryptocurrency started a brand new ascend into value discovery. This time macro-economic situations are completely different, and Bitcoin might retest its yearly low of round $17,000, however McGlone suggests it has reached a degree the place long-term holders might revenue within the second half of 2022:

(…) the Bloomberg Galaxy Crypto Index nearing an analogous drawdown because the 2018 backside and Bitcoin’s low cost to its 50- and 100-week transferring averages much like previous foundations, we see threat vs. reward tilting towards responsive buyers in 2H.

Since its inception, BTC’s value has traditionally discovered a backside round earlier all-time highs. McGlone claims there are situations for $20,000 to function as this pivot assist degree in 2022 on the again of a decline in “threat measures” towards the standard market.

Bitcoin at $20,000 could also be regarded again upon like $2 in 2011, $200 in 2015 and $3,000 in 2018. Bitcoin and Ether threat measures are falling vs. equities and the potential for US regulation (Lummis-Gillibrand crypto plan) reveals mainstream maturation.

Bitcoin Quick Time period Outlook Present Enchancment?

On decrease timeframes, Bitcoin has been capable of keep above $20,000 regardless of the decline in conventional markets and the energy of the U.S. greenback. The U.S. forex is approaching a 20-year-old excessive as buyers proceed to de-risk amid present macroeconomic situations.

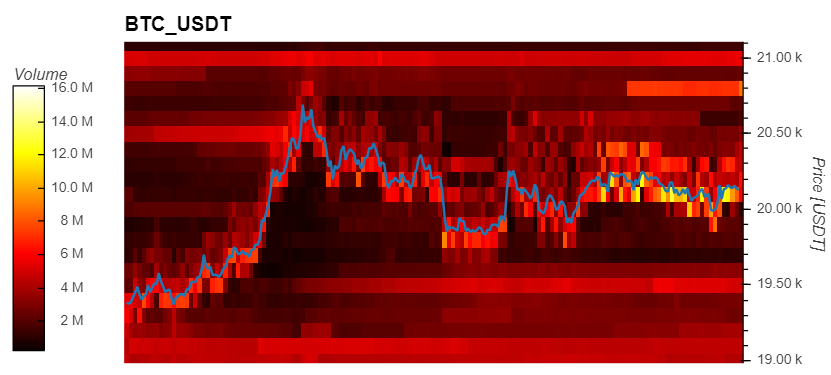

Information from Materials Indicators (MI) data round $20 million in bid orders for BTC’s value from $20,000 to $19,000. These ranges ought to function as assist in case of additional draw back as BTC whales proceed to build up.

Associated Studying | TA: Bitcoin Faces One other Rejection, Can Bulls Save The Day

Bigger BTC buyers have been shopping for into the cryptocurrency’s value motion over the previous week. Addresses with 100 to 100,000 BTC added 30,000 BTC over this era.

Up to now week, addresses with 100 to 10,000 $BTC added roughly 30,000 #BTC to their holdings whereas 40,000 #Bitcoin have been withdrawn from identified #cryptocurrency alternate wallets. pic.twitter.com/vRC7cJYvbZ

— Ali Martinez (@ali_charts) July 4, 2022

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)