Abstract:

- The variety of Bitcoin addresses holding 0.01 or extra BTC has hit a brand new all-time excessive of 10.088 million.

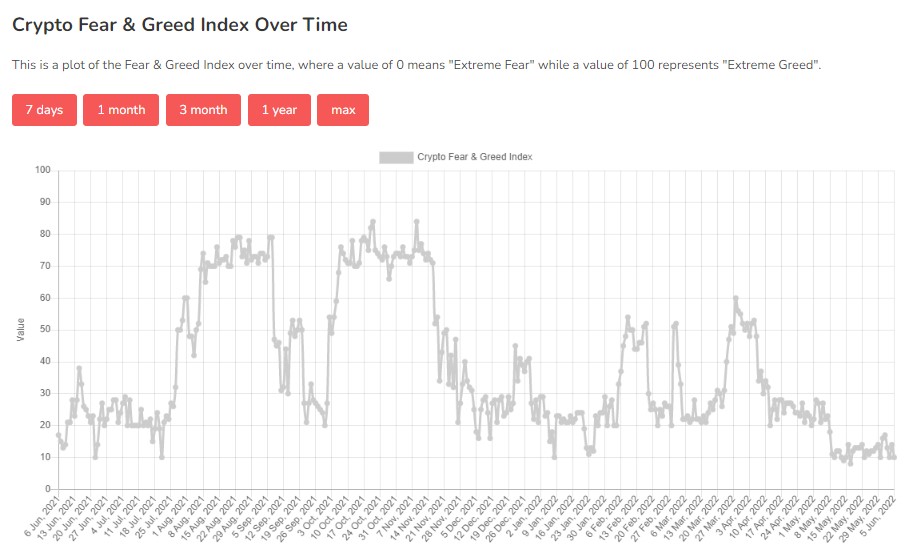

- The brand new milestone is regardless of the Crypto Concern and Greed index hitting an virtually report low of 10, hinting that crypto merchants are cautious concerning the short-term way forward for digital belongings.

- Bitcoin is as soon as once more buying and selling beneath the essential $30k resistance degree that might sign additional losses within the month of June.

The variety of Bitcoin addresses holding 0.01 or extra BTC has hit a brand new milestone. Based on the crew at Glassnode, the variety of such addresses has hit a brand new all-time excessive of 10.088 million. The Glassnode crew shared their statement on the variety of Bitcoin holders with 0.01 or extra BTC by the next tweet, which features a chart exhibiting the encouraging development of such traders.

📈 #Bitcoin $BTC Variety of Addresses Holding 0.01+ Cash simply reached an ATH of 10,088,913

Earlier ATH of 10,088,419 was noticed on 02 June 2022

View metric:https://t.co/oyguxpaA2y pic.twitter.com/iYQMfLEp56

— glassnode alerts (@glassnodealerts) June 5, 2022

Crypto Concern and Greed Index Hits an Nearly Document Low of 10.

The variety of Bitcoin holders with 0.01 BTC or extra hitting an all-time excessive comes when the final temper within the crypto markets is one among worry. This factors to the potential for retail traders accumulating Bitcoin at present ranges regardless of the general temper of worry within the crypto markets.

On the time of writing, the Crypto worry and greed index is at a worth of 10, which is an indicator of maximum worry.

Moreover, a worth of 10 is the second-lowest worth of the crypto worry and greed index within the final 12 months. Could seventeenth’s worry index was the bottom in the identical interval, at a worth of 8, because of the crypto-wide selloff catalyzed by UST’s depegging occasion.

Bitcoin Continues to Battle to Keep a Stage Above $30k.

With respect to cost motion, Bitcoin is buying and selling beneath the essential $30k resistance degree at its present worth of $29,700. As well as, Bitcoin stays in bear territory, buying and selling beneath the 50-day (white), 100-day (yellow), and 200-day (inexperienced) transferring averages, as seen within the chart beneath.

Additionally, from the chart, it may be noticed that the each day MFI, MACD, and RSI are all hinting at a situation of decreased shopping for of Bitcoin.

Consequently, Bitcoin has a excessive probability of both persevering with its consolidation between $30k and $29k or falling decrease to retest $28k and even the native low of $26,700 skilled in early Could because of the Terra/UST saga.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)