- A decline in ETH’s Transaction Rely metric means that it would contact $1000 within the coming yr.

- On-chain evaluation confirmed the extended decline in market exercise.

With a constant decline in new demand for main altcoin Ethereum [ETH], its value may fall beneath the $1000 mark, CryptoQuant analyst Greatest Trader opined.

Learn Ethereum’s [ETH] Worth Prediction 2023-2024

The analyst carried out an evaluation of ETH’s Transaction Rely metric (30-day EMA) and located that there was a gentle decline since Could 2021 to mark a brand new low of 937,653 day by day transactions as of 27 December. A decline in transaction rely is typical in bear markets resulting from lowered exercise from market individuals.

In line with Greatest_Trader:

“As is obvious within the chart, every impulsive downtrend within the metric was together with a substantial value decline. Most lately, the metric skilled a big plunge indicating a scarcity of exercise. Therefore, the value may quickly expertise one other drop to the essential help stage of $1K.”

Supply: CryptoQuant

Legitimate or not?

The standing of ETH’s On-balance quantity (OBV) on a day by day chart lent credence to the analyst’s place above. At 39.491 million at press time, ETH’s on-balance quantity has declined severely since 5 Could. It has since gone down by 42%. Throughout the similar interval, ETH’s value has fallen by over 50%.

Are your ETH holdings flashing inexperienced? Verify the Revenue Calculator

A declining OBV means that there could also be extra promoting strain than shopping for strain, which may point out that the asset’s value could also be poised to fall. A constant decline in OBV means an extra decline in an asset’s value is believable.

Supply: TradingView

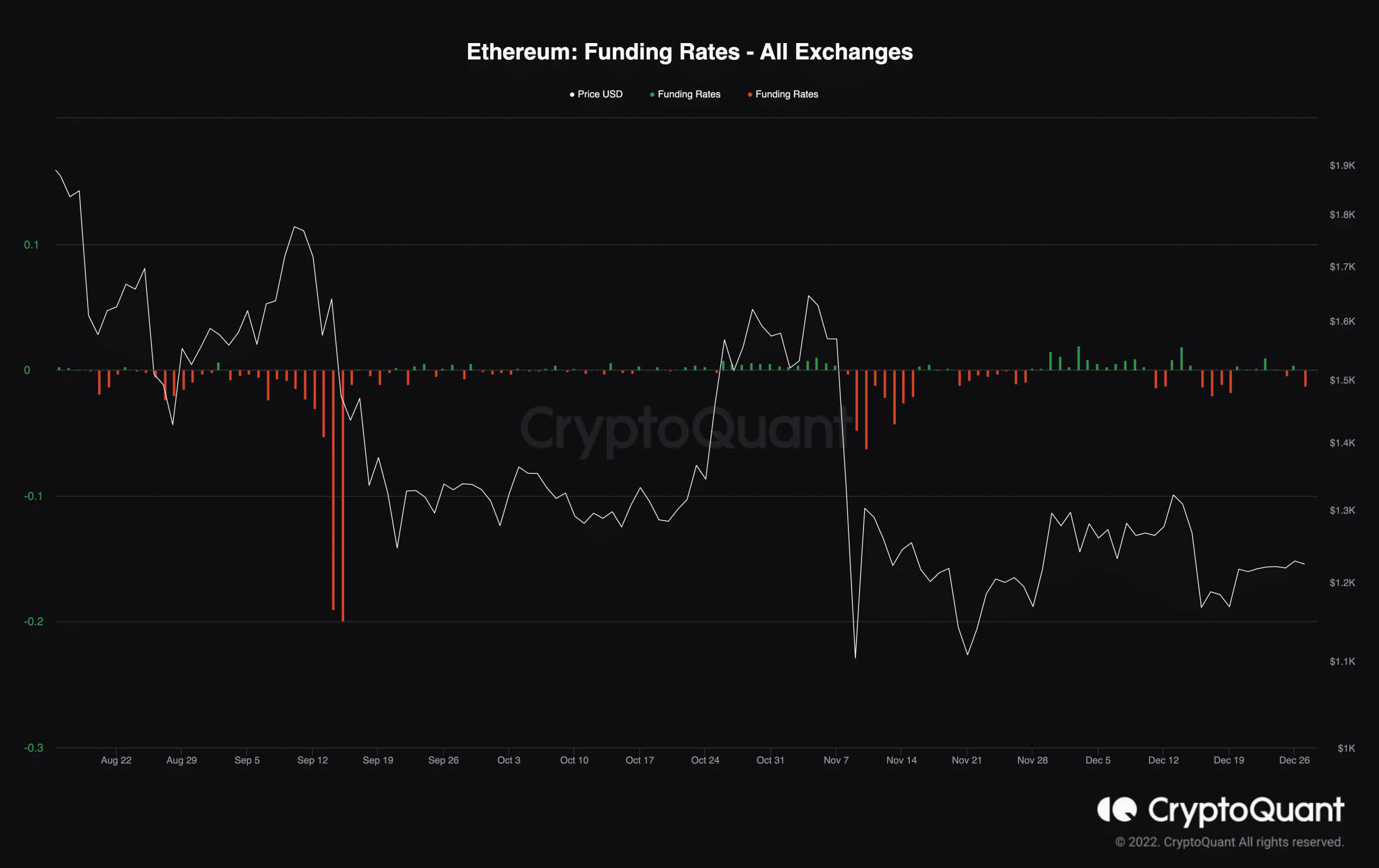

Additional, since FTX’s surprising fallout, the ETH market has been stuffed with many merchants betting towards a value rally within the brief time period. ETH’s funding charges have largely been unfavorable because the FTX debacle began on 6 November, displaying that short-position merchants have largely dominated the market since then.

Supply: CryptoQuant

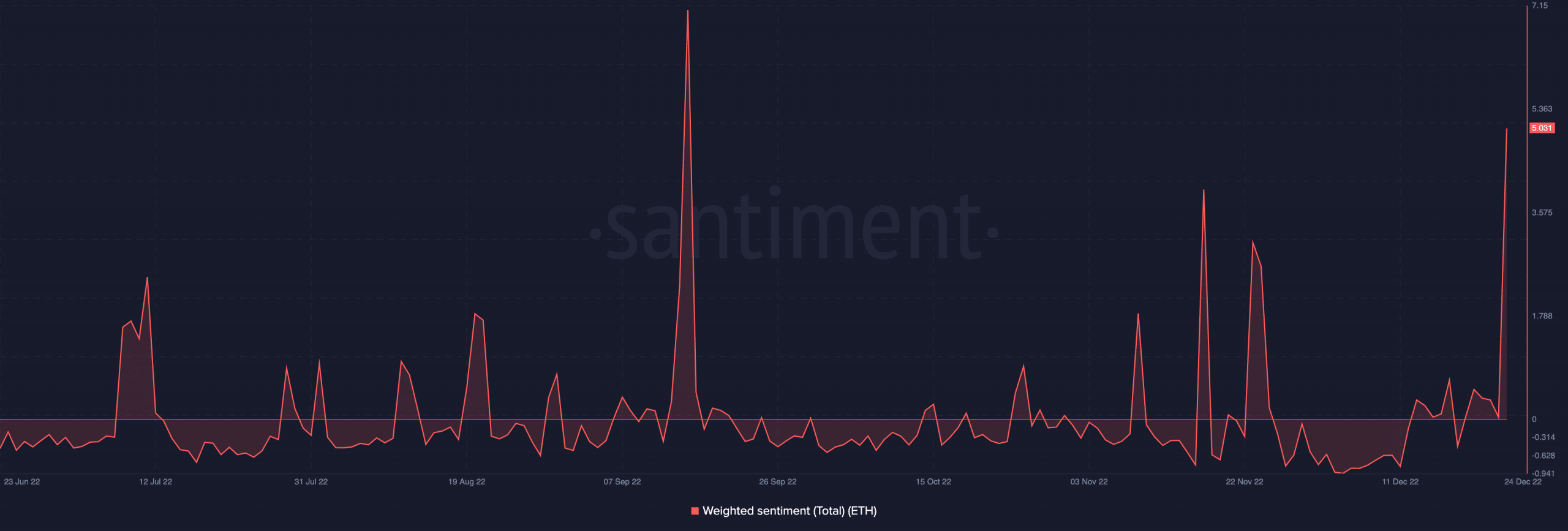

A rise within the rely of brief merchants betting towards an asset’s value is commonly a transparent indication of the place market sentiment lies. As for ETH, its weighted sentiment has largely been unfavorable (with few moments of reversal) previously few months. This exhibits that traders at present lack the conviction required to provoke a value rally, and ETH’s worth may proceed to get crushed down by bears.

Supply: Santiment

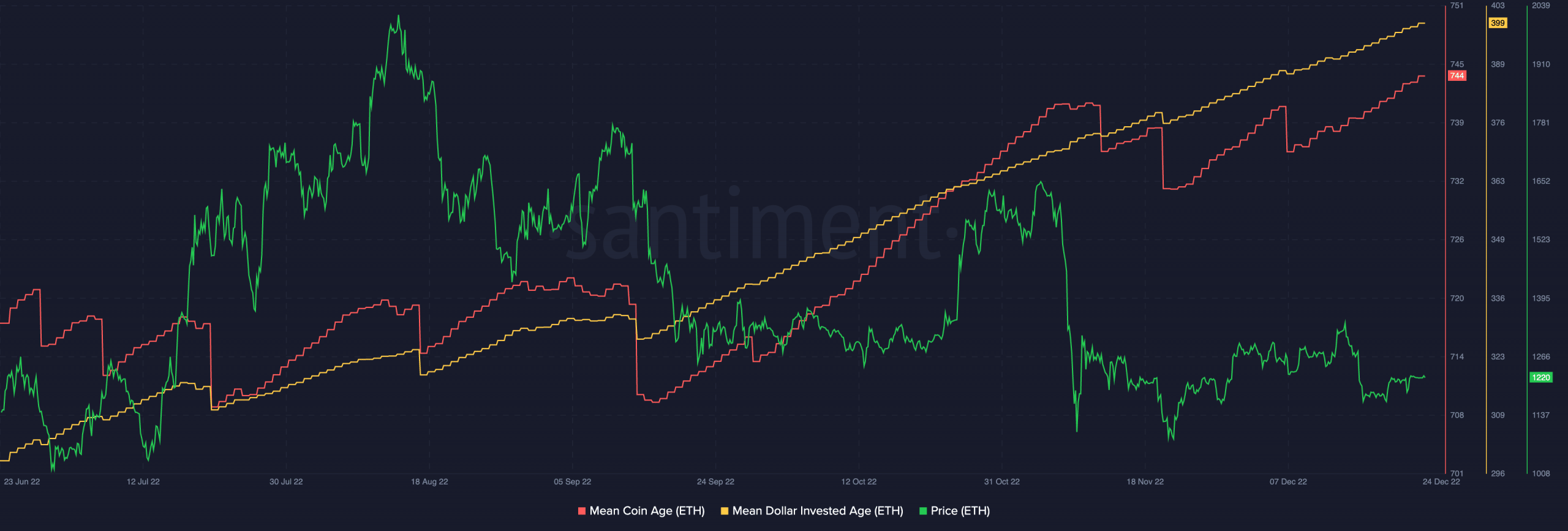

As well as, an evaluation of ETH’s Imply Coin Age (MCA) and Imply Greenback Funding Age (MDIA) revealed the presence of dormancy on the alt’s community. Save for when the merge occurred, and through the FTX debacle when long-held ETH cash modified palms, many ETH cash have remained dormant in pockets addresses for a number of months.

The extended stretch in ETH’s MCA and MDIA usually implies that there’s some regarding stagnancy on the coin’s community, which is able to make it arduous for its value to rise.

Supply: Santiment

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)

![Assessing whether or not Ethereum’s [ETH] price will fall below $1000](https://cryptonoiz.com/wp-content/uploads/2022/12/shubham-dhage-geJHvrH-CgA-unsplash-1-1000x600-750x375.jpg)