- Ethereum (ETH) complete worth staked has surpassed 15.9 million.

- The rise within the worth of ETH is perhaps a significant contributor to the rise in stake influx.

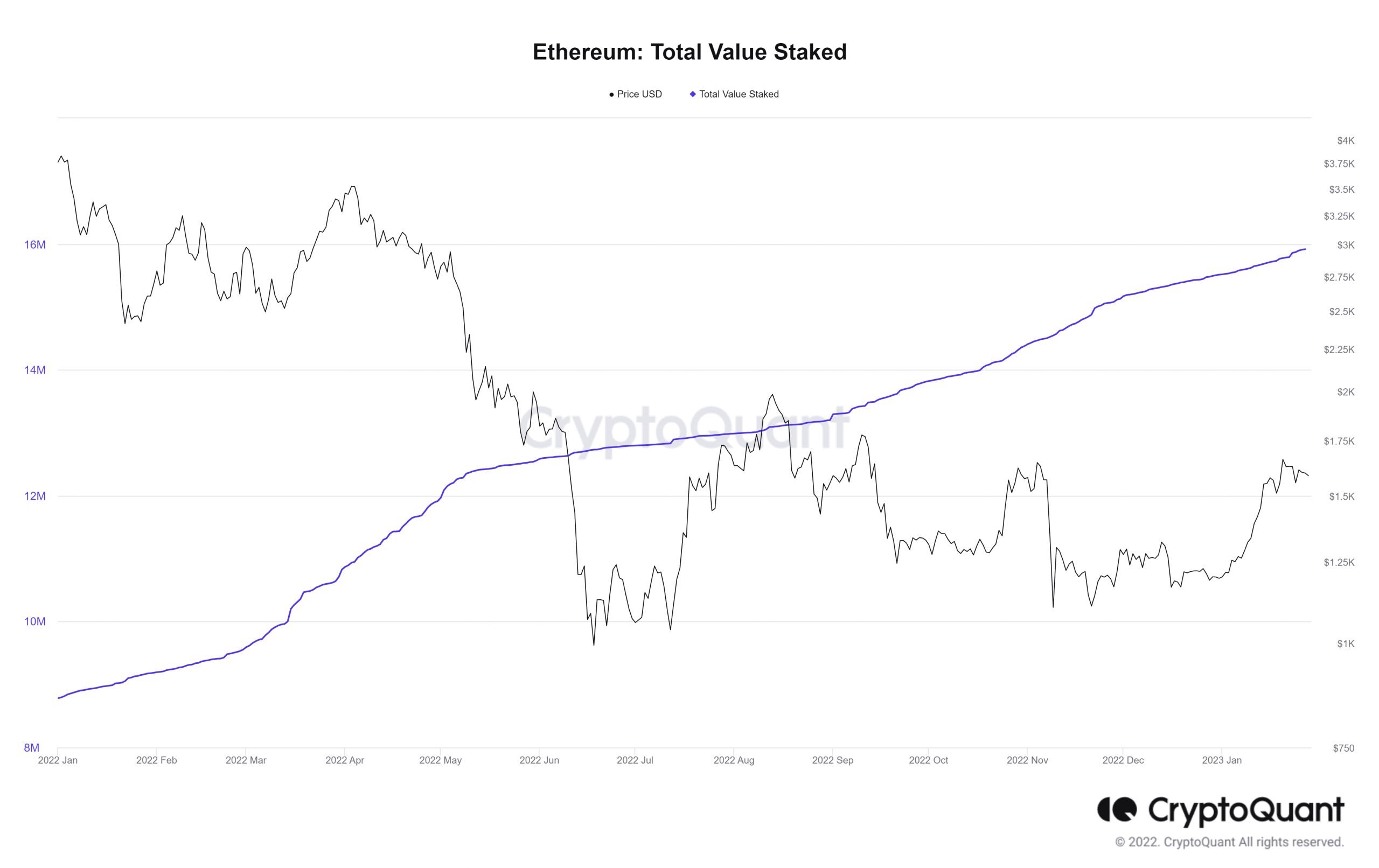

For the reason that merge, validators have been in a position to contribute to community safety by staking their Ethereum [ETH]. Nevertheless, the overall quantity of ETH that has been staked has elevated and now stands at a file excessive. Is there any cause to count on extra stake will increase, and what could possibly be driving the present ones?

Learn Ethereum’s [ETH] Worth Prediction 2023-24

Whole worth staked hit record-high

The second-largest blockchain, Ethereum, reached a big new milestone on 27 January, practically 4 months after it transitioned to a proof-of-stake community. In keeping with Crypto Quant, over 15.9 million ETH have been staked on the Ethereum Beacon Chain.

The entire variety of ETH staked has reached a brand new all-time excessive of 15,9 million

• Accounting for greater than 13% of the overall ETH provide.

1/6 🧵👇 pic.twitter.com/wesx84E2hK

— CryptoQuant.com (@cryptoquant_com) January 27, 2023

At press time, the overall quantity staked is over $25.3 billion, and this additionally represented over 13% of the overall ether provide. That is about two years after the launch of Ethereum’s staking contract in 2020, when the community’s proof-of-stake Beacon Chain was launched.

Supply: Crypto Quant

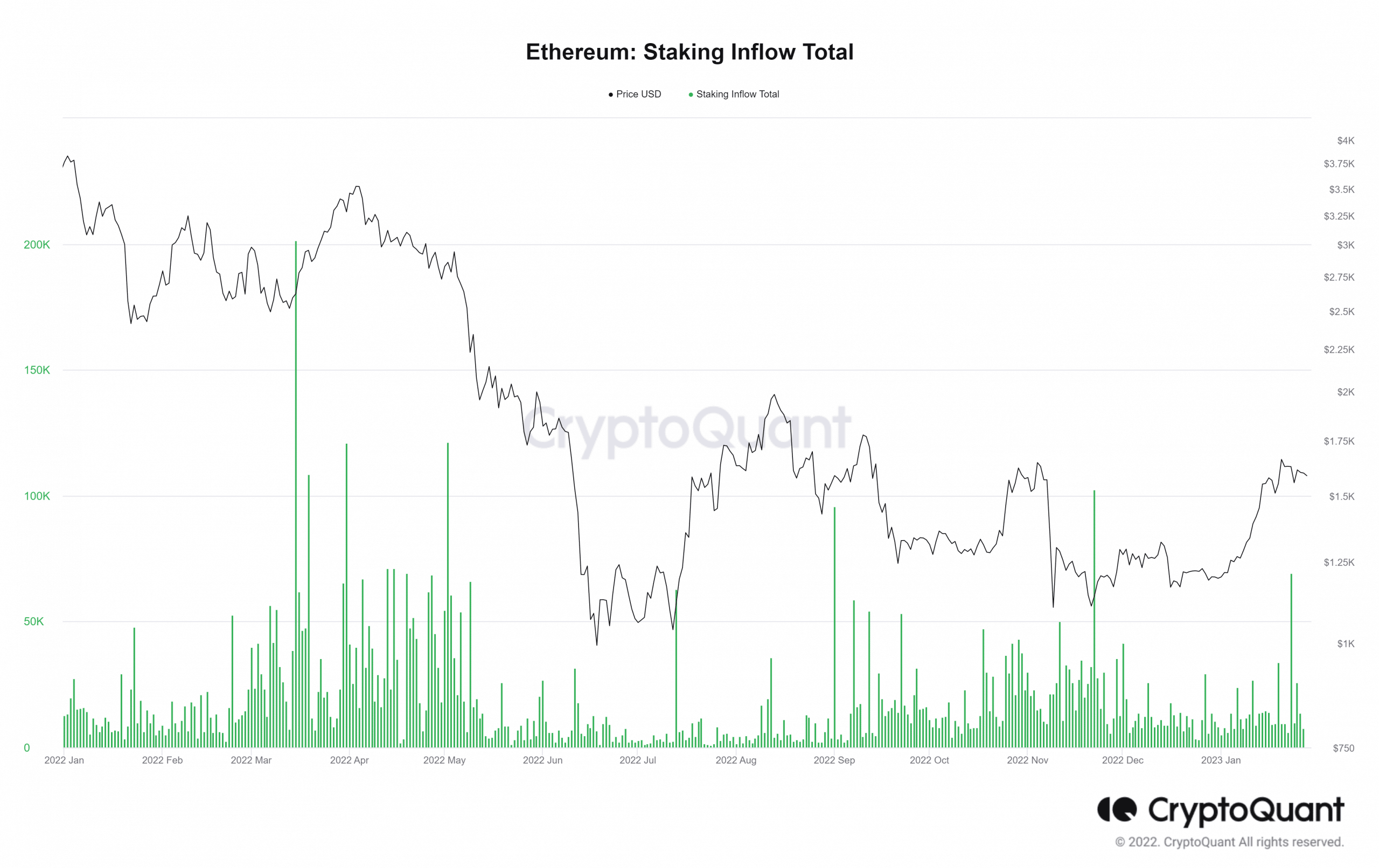

ETH Staking Influx and New Depositors see fixed actions

Extra examination of a number of different charts, such because the Staking Influx Whole chart, revealed some intriguing findings. The documented staking inflow elevated originally of the week. It reached over 69,000, essentially the most important degree since November 2022.

January has had the next stake influx than December of the prior 12 months total.

Supply: Crypto Quant

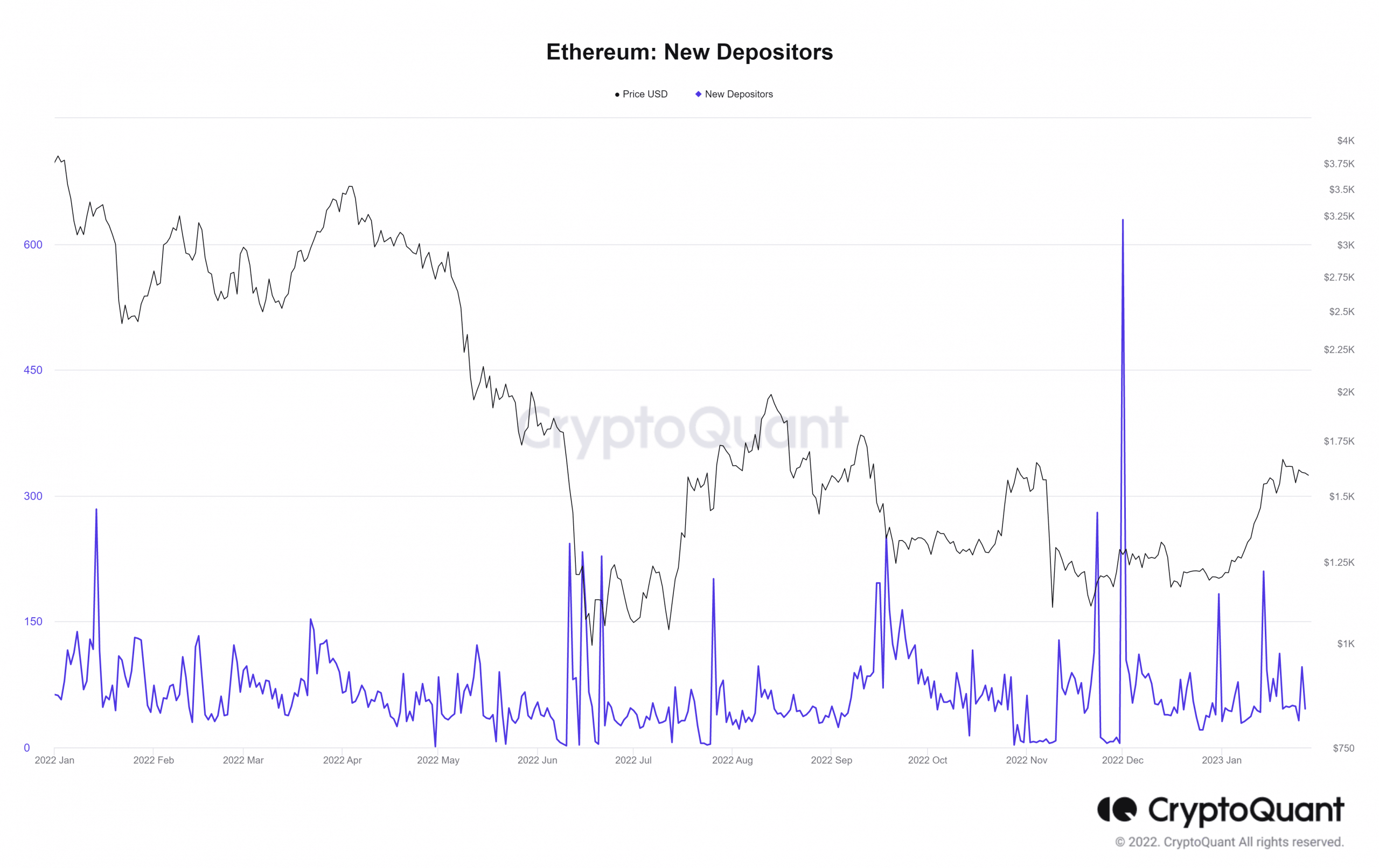

Despite the fact that there have been no spikes, a peek on the New Depositors chart offered additional details about Ethereum staking. As of the time of this writing, 46 new depositors had been listed for 27 January. Even whereas this will not be a big quantity, the chart demonstrated a gradual stream of latest depositors. With this in thoughts, one might marvel why stakes are consistently getting into the community.

Supply: Crypto Quant

Attainable causes for an elevated stake

Ethereum was buying and selling at about $1,590 on the time of this writing. For the reason that starting of January, the asset’s value has elevated by 33%, as proven by the present worth degree. One reason behind the rise in staking could also be a worth surge much like the one Ethereum not too long ago noticed.

This was paired with the notion that the Shanghai Improve, which might permit the withdrawal of staked ETH, is imminent. To offer incentives, staking payouts will rise in response to a big ETH withdrawal when the withdrawal characteristic is activated.

Supply: Buying and selling View

Is your portfolio inexperienced? Take a look at the Ethereum Revenue Calculator

Staking rewards for ETH lower as extra of the cryptocurrency is staked. Till the merge’s completion, Ethereum validators have an APY of roughly 5%. Nevertheless, APY is highest for people operating their validator nodes.

Staking ETH by means of a centralized change or a staking pool would possible end in diminished earnings due to the validator charges that will probably be paid. The one time that is completely different is when centralized exchanges use promotional methods to extend their reward APYs above on-chain charges to draw staking market share.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)

![Ethereum [ETH] metric sees correction: Hopes of a bull run rise](https://cryptonoiz.com/wp-content/uploads/2023/01/ethereum-wale-1000x600-750x375.jpg)