- Lido’s share of the ETH staking market now sits at 29%

- The APR supplied witnessed a decline as properly.

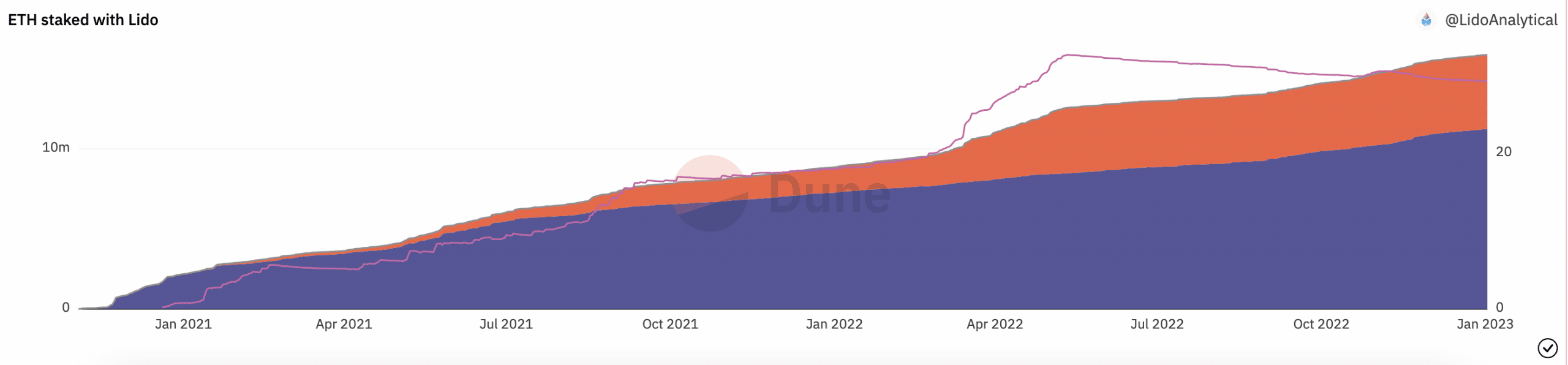

Lido Finance [Lido] commenced the 2023 buying and selling 12 months with a slight decline in its market share within the ETH staking ecosystem. The leading liquid Ethereum [ETH] staking platform’s efficiency was highlighted by Dune Analytics.

Learn Lido Finance’s [LDO] Value Prediction 2023-2024

Who sits the staking throne?

With continued development within the variety of choices obtainable to market gamers to stake their Ether, Lido’s place as a pacesetter stays regularly threatened. In response to Dune Analytics, after Lido’s share of whole ETH staked touched 30%, it held on to the determine between September and early December.

Nonetheless, this slipped additional to the touch 29% for the primary time since April 2022. Moreover, on the time of writing, Lido’s market share of whole ETH staked stood at 29.07%.

Supply: Dune Analytics

Per knowledge from the on-chain analytics platform, Lido’s share of the ETH staking market constantly declined since Could 2022. Moreover, this may very well be attributed to a surge within the variety of ETH staking platforms because the merge drew nearer.

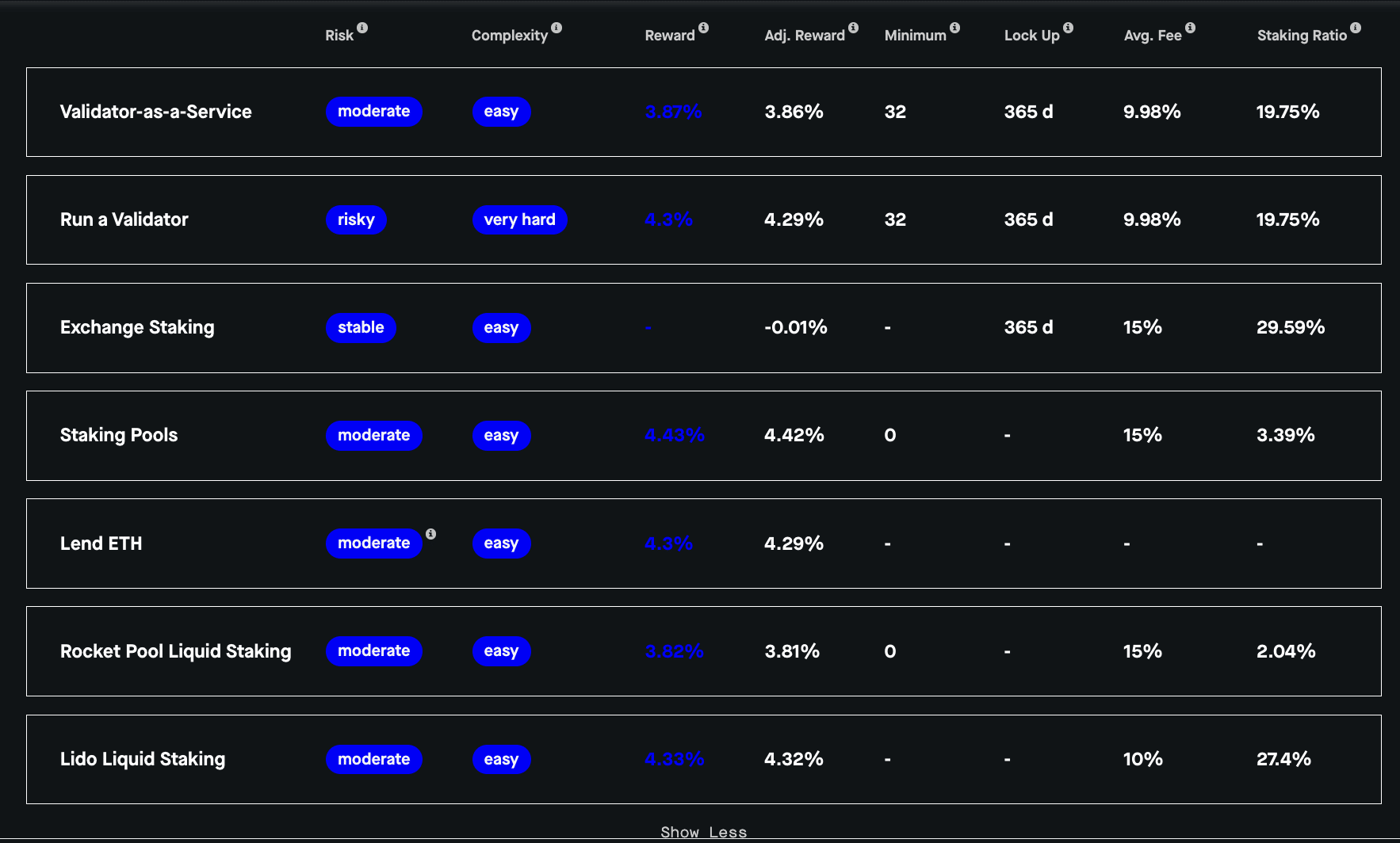

In response to knowledge from Staking Rewards, an evaluation of the assorted means by which ETH may very well be staked revealed that many stakers most popular to stake through cryptocurrency exchanges.

What number of LDOs are you able to get for $1?

Of the assorted ETH staking modes, the staking ratio for alternate staking stood at 29.59%, the very best available in the market. It was additionally properly positioned above Lido’s liquid staking ratio of 27.4%.

The elevated desire to stake ETH on exchanges was additionally a contributory issue to the gradual decline in Lido’s maintain available on the market.

Supply: Staking Rewards

Moreover, the Annual proportion price (APR) earned for staking through Lido clinched its lowest level since November at press time. On the time of writing, Lido supplied an APR of 4.30%.

This represented a 58% decline from its APR all-time excessive, which was recorded three months in the past. The persistent decline in APR may very well be a cause why Lido’s maintain available on the market has been slipping.

Supply: Dune Analytics

The place does LDO stand in the long term?

The rationale for the persistent drop in Lido’s APR wasn’t far-fetched. This was as a consequence of low exercise on the Ethereum community. Low exercise led to decreased Execution Layer rewards, knowledge from Dune Analytics confirmed.

As of this writing, Execution Layer rewards on Ethereum stood at 0.9%. As of 13 November, this was pegged at 11.3%.

With elevated ETH staking forward of the Shanghai Replace scheduled for later this 12 months, it stays to be seen what’s to turn out to be of Lido Finance and its place available in the market.

Supply: Glassnode

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)