Abstract:

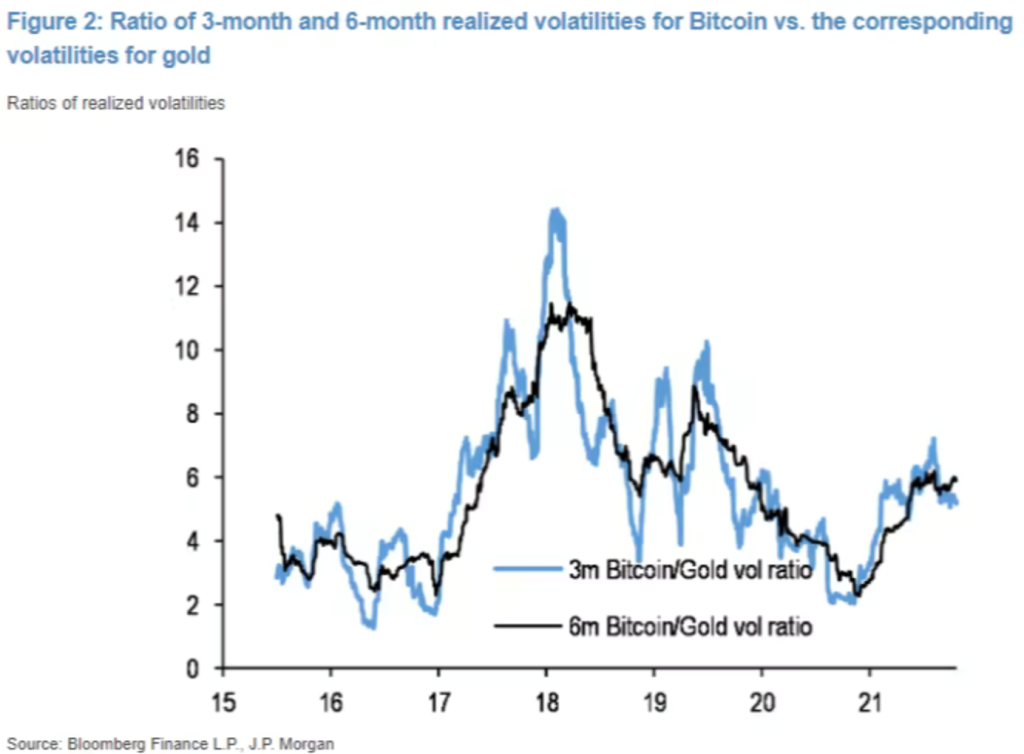

- A chart by the workforce at JP Morgan Chase superimposes Bitcoin’s and Gold’s ratios of realized volatilities and hints that BTC is performing rather a lot just like the latter asset.

- Bitcoin’s market cap and that of Gold might ultimately equalize as they serve the identical goal.

- However Bitcoin’s volatility hinders its market cap from rising to the extent of Gold.

- Analysts forecast that Bitcoin might retest $20k or decrease this 12 months.

- Guggenheim’s Chief Funding Officier sees Bitcoin retesting $8k or decrease because it has but to show itself as a reputable institutional funding.

A chart by the workforce at JP Morgan Chase hints that Bitcoin is presently performing rather a lot like Gold. The chart, shared beneath and courtesy of the workforce at Fortune journal, reveals the ratio of the three-month and six-month realized volatilities of Bitcoin versus that of Gold.

Bitcoin’s and Gold’s Market Cap might Equalize as they Serve the Similar Function.

Moreover, the report by the workforce at Fortune additionally forecasts that the overall market cap of Bitcoin and Gold might ultimately equalize as they serve the identical goal. However, the market cap of Bitcoin held by institutional buyers is not going to improve quickly until its volatility stabilizes to snug ranges, as defined within the following assertion.

…as a result of volatility is so essential in relation to institutional buyers’ danger administration, the market cap of Bitcoin held by establishments possible gained’t attain gold’s stage till its volatility subsides.

Guggenheim’s Chief Funding Officer sees Bitcoin retesting $8k

With respect to Bitcoin’s short-term value motion, the report by the Fortune MAgazine workforce hinted that BTC might fall to beneath $20k earlier than the tip of this 12 months.

The potential of Bitcoin buying and selling beneath $20k was additionally shared by Guggenheim’s Chief Funding Officer, Scott Minerd, in a Bloomberg interview on the World Financial Discussion board in Davos, Switzerland. Throughout the interview, Mr. Minerd said that he anticipated Bitcoin to fall to $8,000 and that the crypto market is stuffed with ‘a bunch of yahoos.’

Based on his evaluation, Bitcoin, on a basic stage, needs to be value $400,000 primarily because of the US Fed’s ‘rampant cash printing.’ Nevertheless, a flash to $8k is likely to be vital to permit for additional progress. Moreover, he said that the Bitcoin and Crypto markets have but to cross the check as credible institutional investments. He said:

Bitcoin and any cryptocurrency at this level has probably not established itself as a reputable institutional funding.

All the things is suspect. Nobody has cracked the paradigm in crypto. We’ve got 19,000 digital currencies … most of them are junk.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)