Bitcoin, the flagship cryptocurrency has remained under $40,000 over the previous few days. The broader market correction has pushed altcoins to commerce under their key assist ranges. Ethereum was priced under $3000 because the coin was rejected from the aforementioned worth degree.

Bitcoin’s robust resistance stands at $40,000 as merchants proceed to exit the market during the last week. Within the final 24 hours, BTC had fallen by 3% and up to now week, the coin registered a 6% depreciation. The crypto market continues to be in an accumulation part.

Elevated accumulation is usually tied to bullish strain available in the market, nonetheless, the market paints a special image. Greater accumulation can be tied with elevated threat/ratio which is principally a bullish indicator for the coin.

Different Metrics To Reinforce That Bitcoin May Choose Up A Bullish Value Course

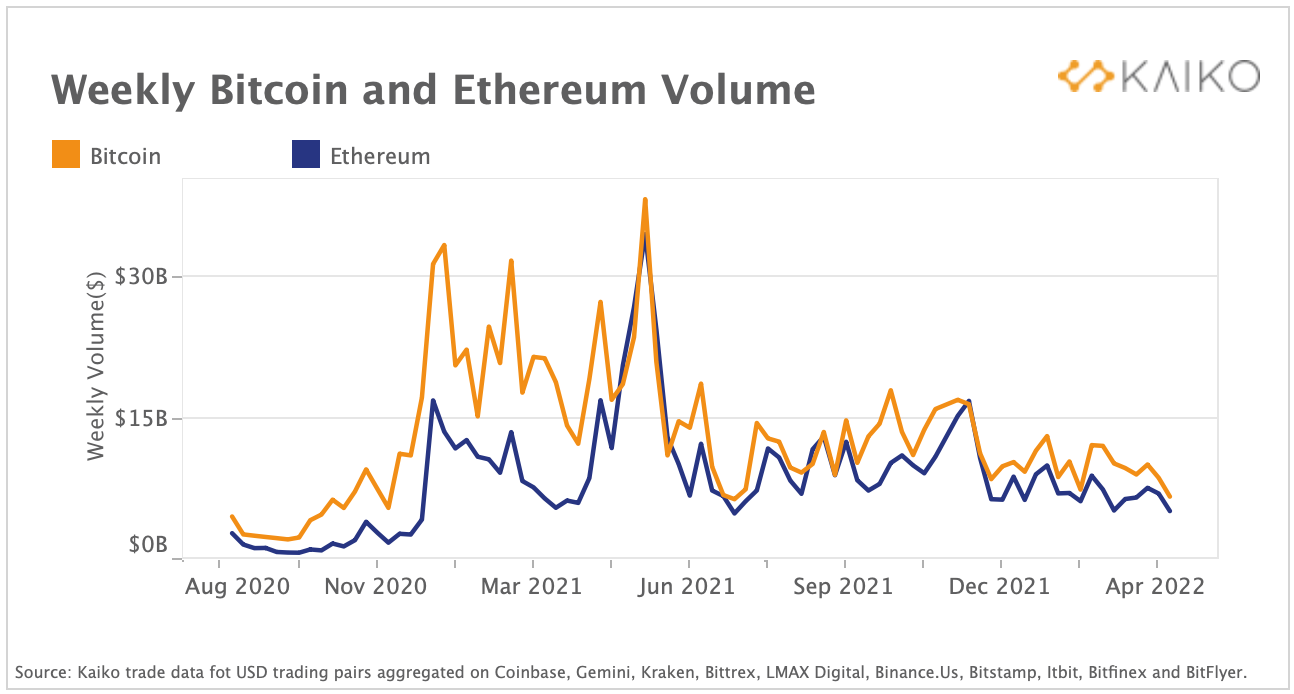

Knowledge from Kaiko show that commerce volumes have gone down for each BTC and ETH. The picture under depicts the dip in commerce volumes seen on main centralized exchanges, it exhibits how BTC and ETH are at their lowest commerce volumes ever for the reason that August 2020 bear market.

Basically, this might imply that individuals may be holding onto their property as the buildup part suggests and that costs are anticipated to go up.

At present, Bitcoin’s short-term worth motion stays bearish amidst a broader market weak point.

Bitcoin Value Evaluation: 4-Hour Chart

Bitcoin was exchanging arms at $38,202 on the time of writing. It broke under its assist degree of $39,800 within the speedy previous buying and selling periods.

BTC has been battling the $40,000 mark for over per week now. Consumers have exited the market which is why the coin continues to battle between the vary of $40,000 and $38,000 respectively.

In case costs see a turnaround, BTC may commerce close to $40,000 and a slight push may assist BTC contact the $42,000 mark, nonetheless, that degree would possibly act as a tricky resistance for BTC. A fall from the current worth will drag the coin to $37,702.

Technical Evaluation

Bitcoin was seen buying and selling under the 20-SMA mark, a studying which means promoting strain is mounting. Sellers had been driving the value momentum within the quick time period.

Simply 48 hours again, patrons had re-entered the market, this quantities to the truth that BTC is making an attempt to rebound on its charts. The coin was briefly positioned above the 20-SMA line simply 24 hours again till BTC began to change for $38,000.

On the Relative Power Index, patrons have once more briefly exited the market and will resurge if demand pushes the coin to rise above 20-SMA.

BTC depicted optimistic worth momentum within the final 24 hours, nonetheless, an extra push brought about the coin to replicate bearishness. The Superior Oscillator flashed inexperienced histograms briefly, at press time AO displayed purple histograms.

MACD that signifies worth momentum displayed inexperienced histograms however corroborated with the AO because the indicator additionally confirmed purple sign bars. The transient inexperienced alerts are a inform that with only a bit of shopping for power, BTC may be up and about.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)