Costs on actual property within the metaverse are primarily decided by the variety of folks that can get uncovered to it, and the way nicely it may be become a yield-generating machine for its homeowners by means of varied monetization methods, a hedge fund principal who makes a speciality of digital belongings has argued in a brand new essay.

“What does it imply to be a ‘neighbour’ within the metaverse? Why does it even matter? What if Snoop Dogg had a number of homes within the metaverse? Do land costs close to all these homes get a premium? Frankly, no one is aware of,” Joel John, a principal on the digital asset-focused funding agency LedgerPrime, opened his essay by saying.

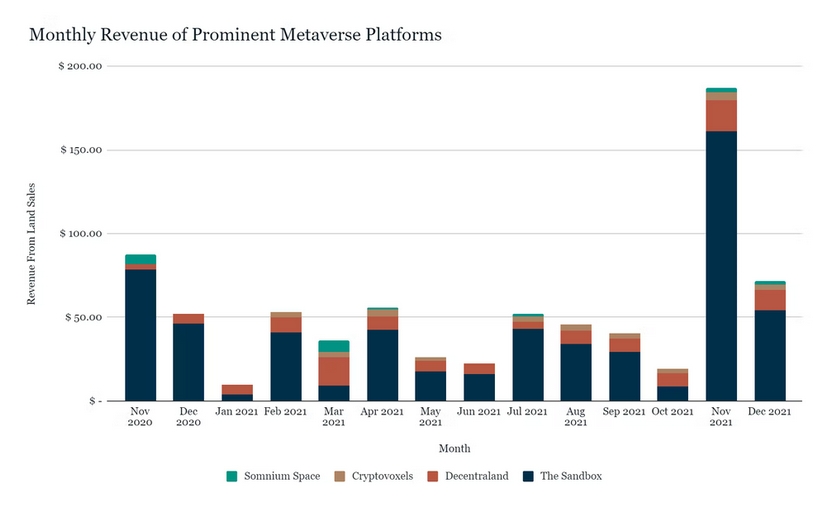

He went on to elucidate that not like tokens, which may be divided into smaller elements, digital plots of land within the metaverse typically require important quantities of capital to purchase. For example, he mentioned the typical worth of a plot of land in The Sandbox (SAND) is round USD 10,399, whereas it’s roughly USD 11,954 for a bit of land in Decentraland (MANA).

To grasp these costs, John wrote, it’s essential to first perceive what land within the metaverse actually is. And in line with him, it’s nothing greater than “a plot the place you possibly can categorical something digitally.”

Extra particularly, the skilled investor argued that there are 5 foremost components that may affect the worth of a bit of digital actual property:

- Total footfall

- Memetic proximity

- Geospatial context

- Financialization

- Artwork.

The primary amongst these, the “total soccer” refers back to the variety of folks that can get uncovered to a bit of digital actual property, very similar to how conventional business actual property is dearer in areas the place many individuals go by.

Then comes what the writer calls “memetic proximity,” which he described as the flexibility to be near one thing or somebody within the metaverse that’s anticipated to generate consideration.

Additional, the geospatial context has to do with how somebody can earn a repute by proudly owning the identical asset as a well known particular person owns, or by proudly owning a bit of land near a well-known particular person or firm.

Subsequent, financialization refers back to the rising interconnection between finance and the metaverse, with varied funding methods employed to make income or generate yields from digital actual property. For instance, yield from metaverse land may come from renting land out, or from splitting wind up into fractions that individuals should buy at decrease costs, John urged. Digital land that’s extra suited to these methods shall be valued larger, he mentioned.

Lastly, the worth of metaverse land will at all times be influenced by the design of the sport it’s in. If the graphics and inner artwork of a recreation are “beautiful,” it’s doubtless that builders will public sale off plots of land within the recreation. The landowners may then promote or in any other case cost charges to different customers for utilizing the land or for letting them go by means of it, John wrote.

In the meantime, countering a generally heard argument that metaverse land can’t be value a lot as a result of it may be generated indefinitely, John acknowledged that he believes this argument rests on flawed logic.

“This is identical as saying blogs will not be value a lot as a result of there are numerous blogs. The worth of a plot of land within the metaverse is immediately proportional to how a lot consideration it will get at completely different closing dates,” he mentioned.

Commenting on the distinction between investing in metaverse land and conventional cryptoassets, the investor famous that these two varieties of digital belongings won’t commerce in the identical means. The explanation for this, he argued, is that the excessive prices of digital land items imply that almost all homeowners will select to “develop” their land.

“These plots have a excessive entry barrier, and even when a collective owns them, they’re incentivized to develop them as an alternative of reselling them instantly for a fast buck,” he wrote.

John concluded that, in his opinion, the present-day metaverse lands ruled by means of decentralized autonomous organizations (DAOs) are “symbolic of the place the web might development in elements and items—decentralised, user-owned and barely loopy,” including:

“The long run – in my eyes, is a remix of the previous.”

____

Study extra:

– Tips on how to Purchase Digital Land within the Metaverse: A Newbie’s Information

– Actual Property within the Metaverse Is Booming. Is It Actually Such a Loopy Concept?

– Investing within the Metaverse: 4 Methods to Put money into Digital Future

– Individuals ‘Will Spend 1 Hour a Day in Metaverse in 4 Years’ Time, Predicts Gartner

– Decentraland Sees a Report USD 913,000 Digital Land Sale

– SAND Rallies as Sandbox Unveils its Upcoming Metaverse Occasion

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)