- 2 February noticed ETH hit $1,713 for the primary time in 4 months.

- The influx of ETH into exchanges exceeds the outflow signifying promote strain.

Ethereum [ETH] skilled a value enhance earlier than the shut of the buying and selling session on 2 February, bringing it to its highest degree in additional than 4 months. How did merchants reply to it, and the way would possibly their responses influence the long run value of ETH?

Learn Ethereum’s (ETH) Value Prediction 2023-24

Breaking resistance briefly

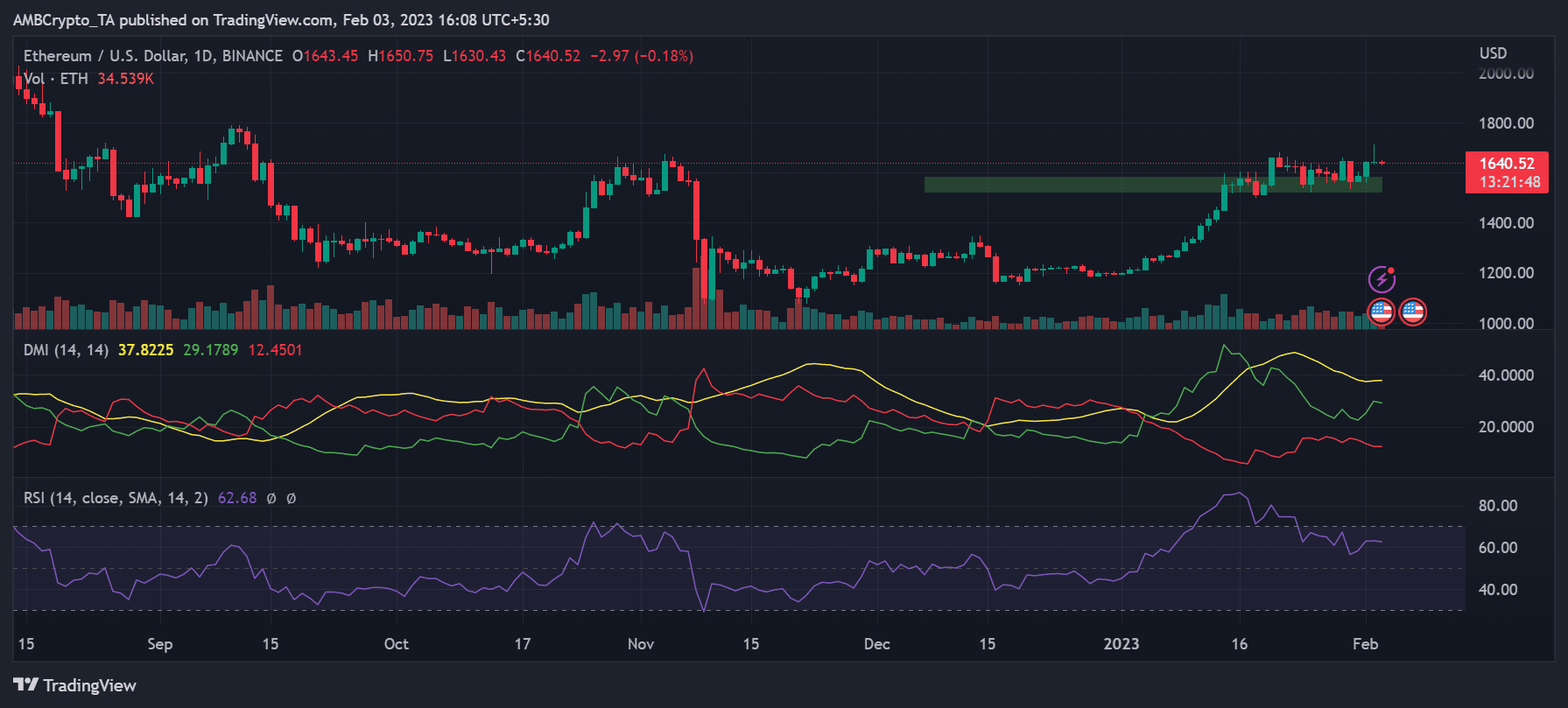

The every day timeframe value chart for Ethereum [ETH] might not have indicated any important value motion on 2 February. When that timeframe is examined extra intently, it could possibly be noticed that ETH broke the $1,700 barrier and briefly traded at $1,713.

For the primary time in additional than 4 months, the worth exceeded $1,500, which prompted merchants’ reactions.

Supply: Buying and selling View

The asset was buying and selling at roughly $1,640 as of the time of this writing, and it appeared to have misplaced a small worth. The worth was nonetheless buying and selling above the assist line that was established close to $1,500 regardless of the modest worth drop.

Moreover, in line with the Relative Energy Index, Ethereum was nonetheless shifting in a bullish course. As of the time of writing, the RSI was above 60 on a every day timeframe.

Scramble for revenue

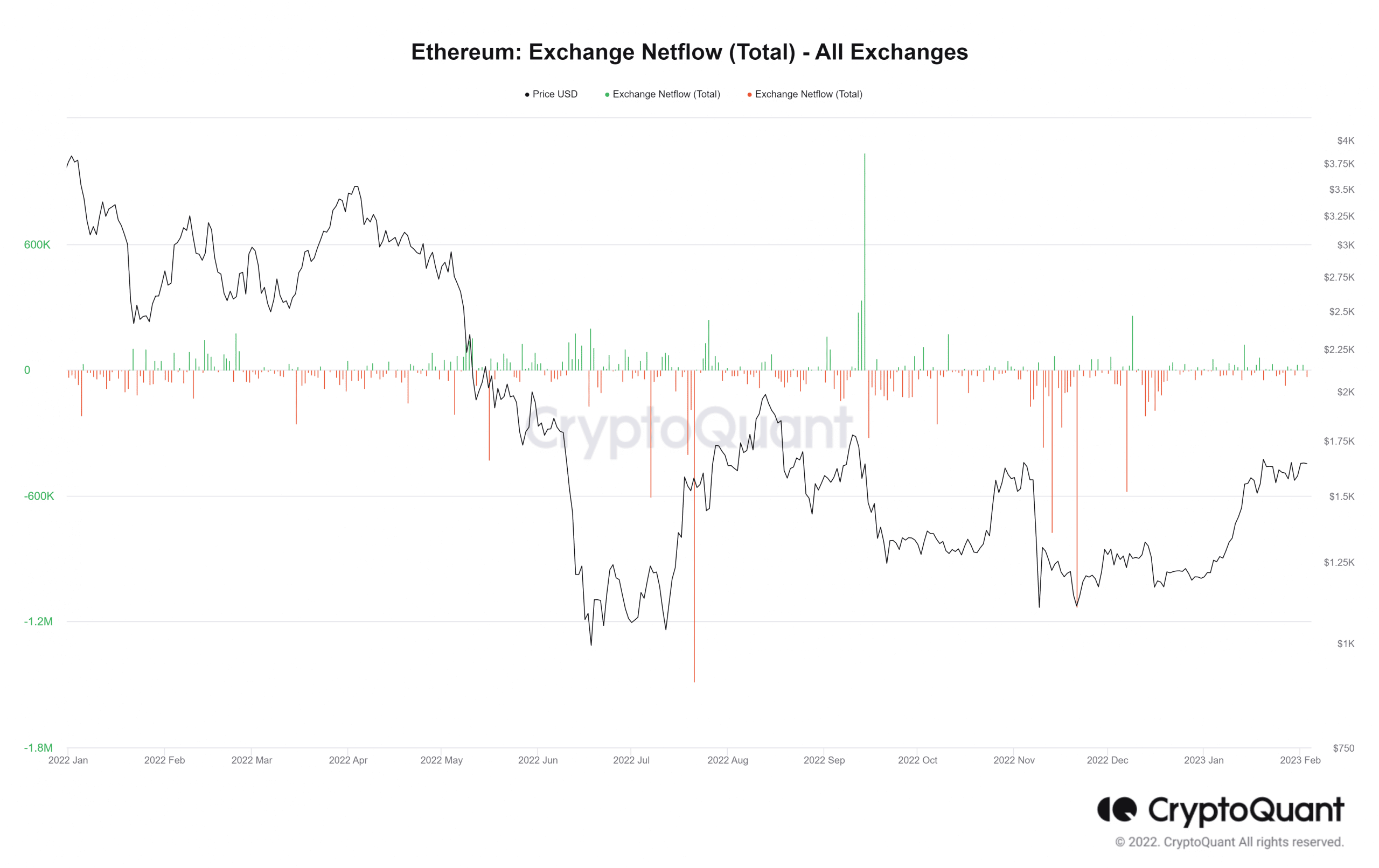

The Netflow measure could also be a extra correct reflection of how buyers reacted to Ethereum’s (ETH) modest achieve on 2 February. The noticed Netflow data exhibits that on 2 February, extra Ethereum (ETH) flowed into exchanges than leaving them.

Sellers had been able to money in for the reason that influx was over 29,000. The noticed inflow, nonetheless, was constant; there was no noticeable surge.

The shortage of a spike might point out that the influx is inadequate to have an effect on the worth of ETH considerably. On the time of this writing, the development line had turned, and outflow exceeded influx.

Supply: Crypto Quant

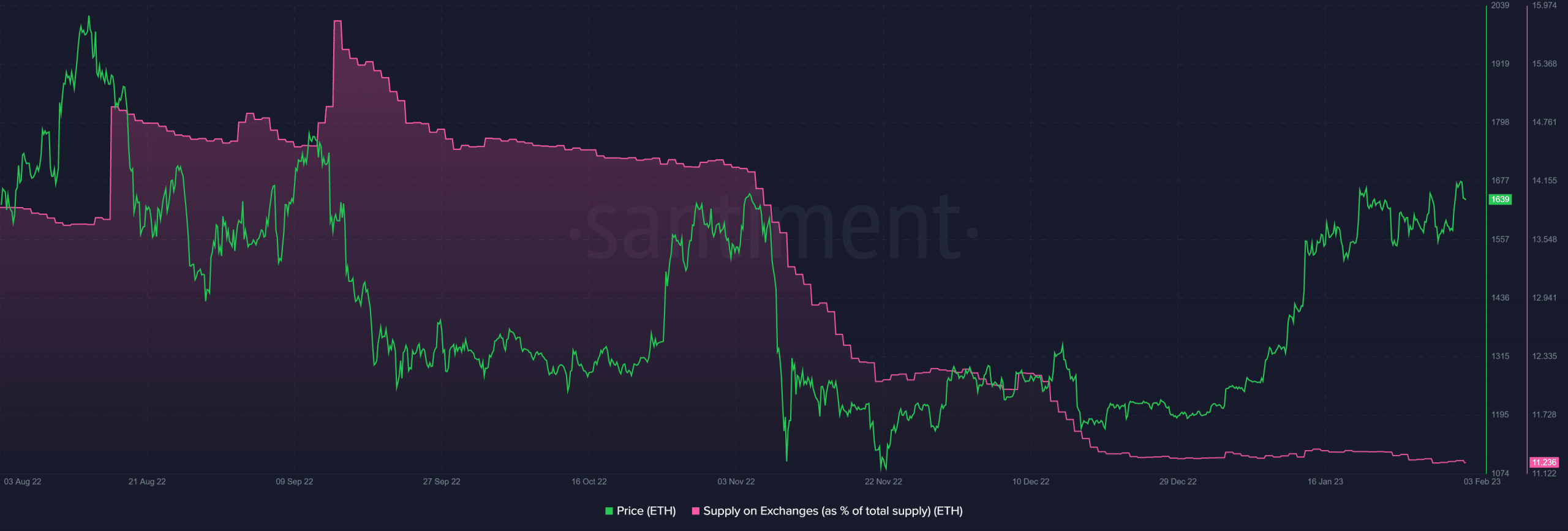

Exchanges see 11% of the overall provide as provide in revenue rise

CoinMarketCap estimates that there’s at the moment greater than 122 million Ether in circulation. The quantity now obtainable on exchanges represents about 11% of the general provide.

Though there was a scramble to money in when the worth of ETH spiked, this implies that solely a tiny fraction of the general provide made its solution to buying and selling platforms.

Supply: Santiment

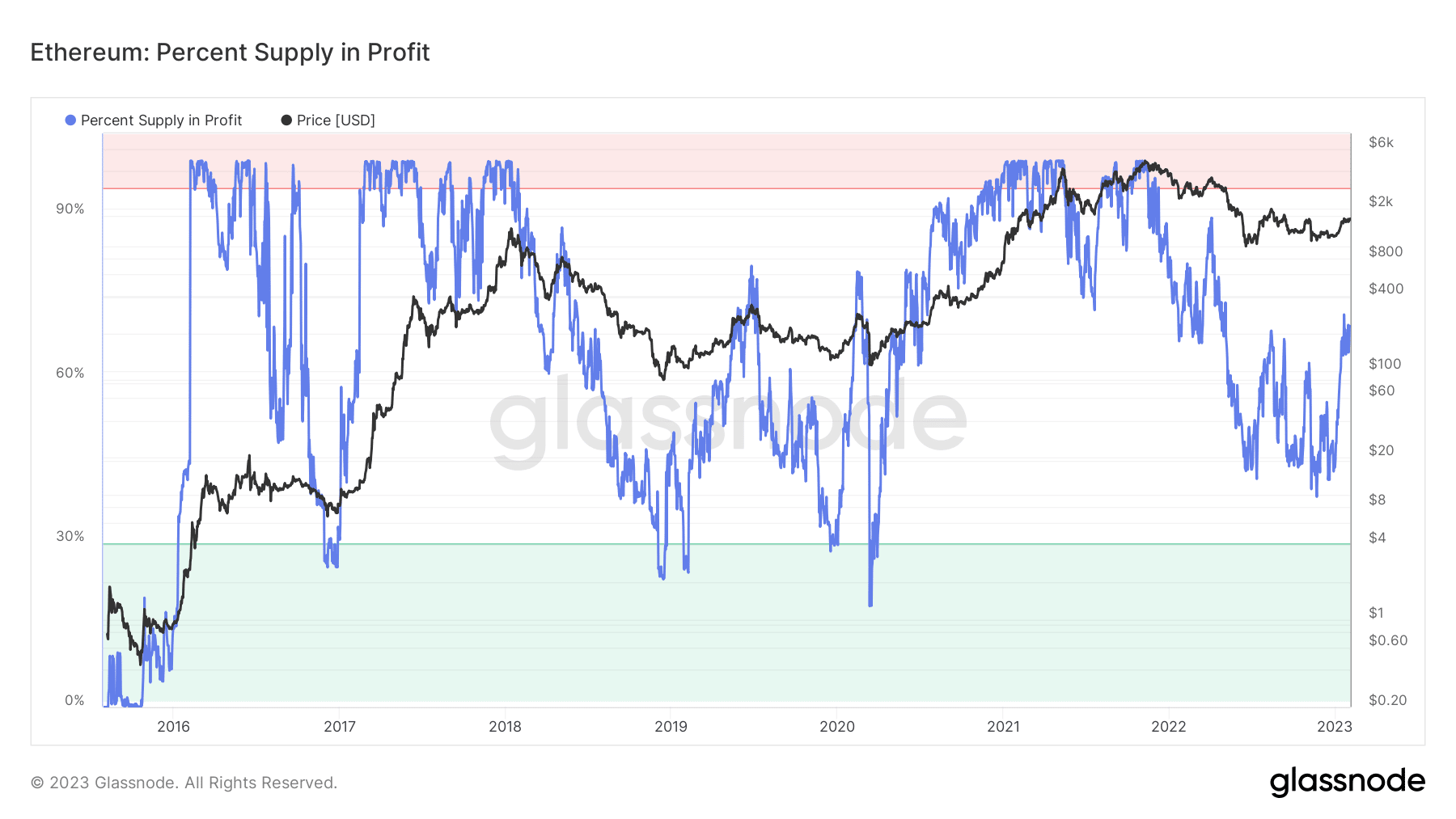

Glassnode’s P.c Provide in Revenue additionally revealed {that a} sizable portion of the ETH provide is at the moment incomes curiosity. Over 64% of the availability, as seen within the noticed graph, was worthwhile as of this writing.

Supply: Glassnode

Is your portfolio inexperienced? Try the Ethereum Revenue Calculator

Quick-term buyers could also be tempted to money out their ETH holdings now that the worth is at its highest level in months. Noticed indicators recommend that extra ETH are being held than offered, so this growth mustn’t have a profound impact on the worth of ETH.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)