- Greater than 70% Ethereum stakes had been underwater at press time

- The Shanghai improve would allow unstaking as soon as deployed

Staking Ethereum [ETH], notably after the Merge, prompted a number of conversations. The matters of dialogue ranged from dominant staking swimming pools to OFAC-compliant blocks, in addition to the threats {that a} mixture of the 2 posed to Ethereum and the transactions that used ETH.

Learn Ethereum’s [ETH] Worth Prediction 2025-2030

Nonetheless, some teams of stakers may be involved about one thing utterly totally different in relation to staking: the quantity of revenue their investments generated.

Stake at a loss?

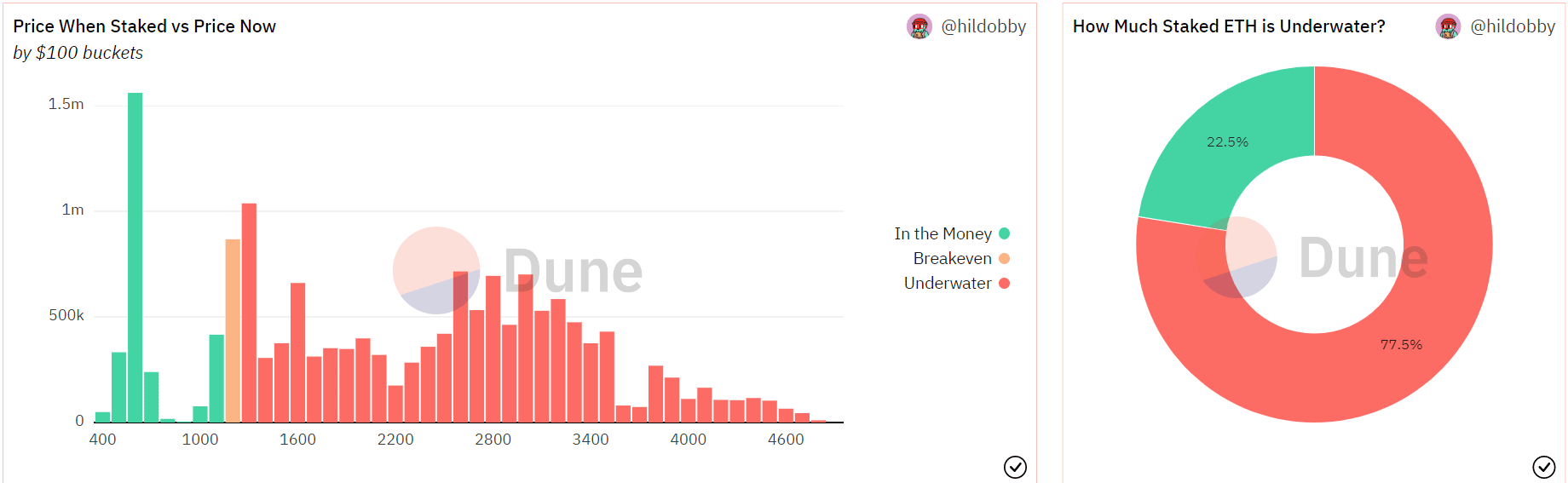

In keeping with Hildobby’s data from Dune Analytics, some ETH stakers had been at present making a revenue, whereas others had been on the breakeven threshold. But, others had been experiencing a loss. In keeping with Dune Analytics, 77.5% stakers had been at a loss at press time, whereas solely 22.5% had been in revenue.

In keeping with the chart, the varied phases of revenue had been determined by the value of Ethereum at varied phases of entry into totally different staking swimming pools by stakers.

Supply: DuneAnalytics

In keeping with the above knowledge, there have been at present over 15k ETH staked, and the whole staked quantity equaled 13.18% of ETH’s whole provide.

Fears of an enormous sell-off following the Shanghai improve have been in style. That is due to the proportion of ETH that was at present locked in staking swimming pools and the present loss {that a} bigger proportion of stakers had been experiencing.

ETH in a day by day timeframe

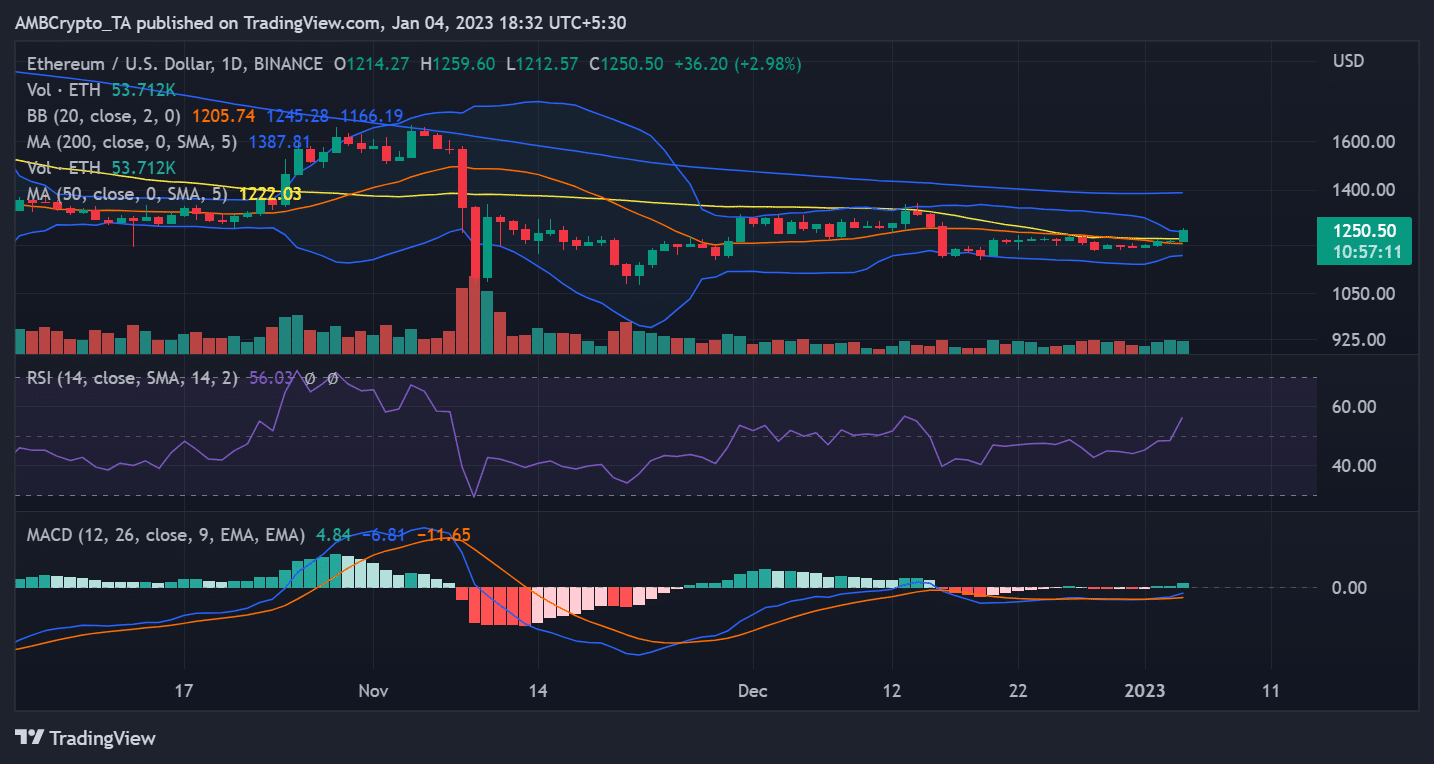

In keeping with the day by day timeframe chart proven, ETH’s worth motion was comparatively flat. As of this writing, the value was seen to have elevated by over 3% over the earlier 48 hours, bringing it to roughly $1,253. The token had made some progress in bouncing again, in response to the Relative Energy Index metric (RSI).

Indicating a constructive development, the RSI line was proven to be above the impartial zone. If the press time upward momentum continues, the situation of the RSI line might strengthen the bullish development.

Supply: TradingView

A sustained rise would possibly trigger ETH to beat totally different resistances and retake the $2,000 space, turning many of the staked ETH into revenue.

Lengthy-term Ethereum holders at a loss…

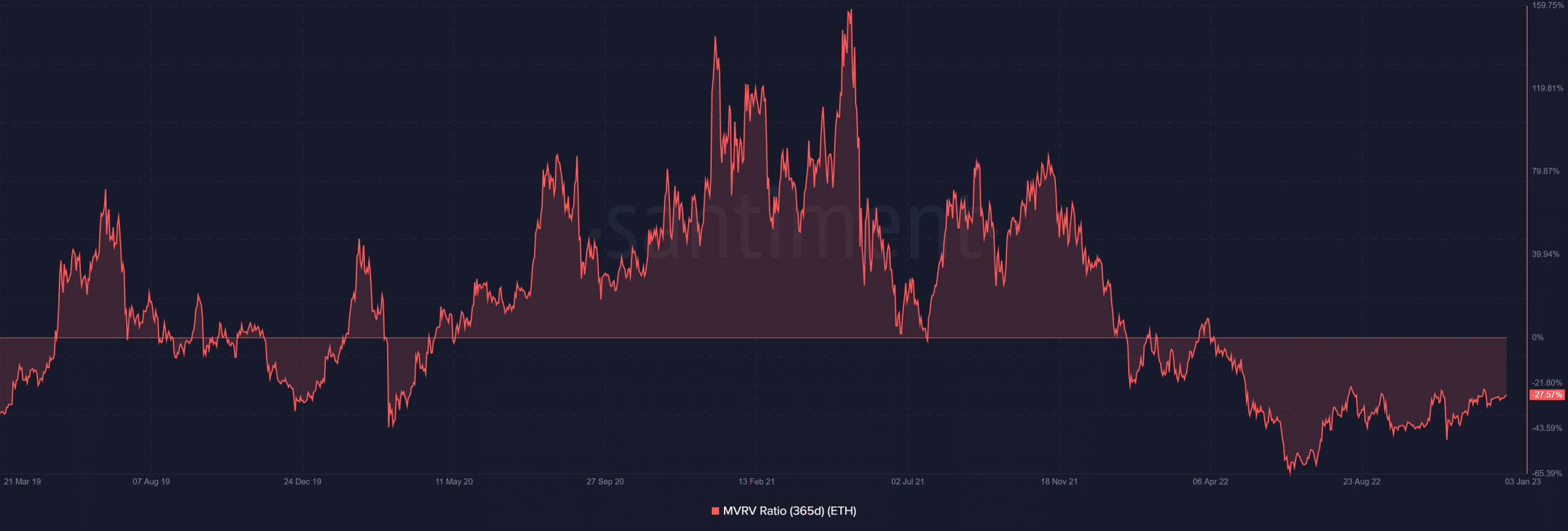

The Market Worth to Realized Worth (MVRV) Ratio for ETH over the past three hundred and sixty five days revealed that holders had been holding at a loss all through that point. Given the difficult yr that cryptocurrencies skilled, ETH holders had been holding at a lack of 27.57% as of this writing, which appeared like a minimal loss.

Supply: Santiment

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)