- ETH noticed a rise within the demand for futures contracts, which can end in rising volatility this week

- Although the metrics had been in favor of the bulls, ETH’s worth noticed a bearish shift

Ethereum [ETH] dashed all hopes for a short-term rally as its efficiency final week was a disappointment. The king of altcoins dropped by 13% from mid-last week to its press time stage. Furthermore, latest observations indicated that ETH would possibly expertise extra volatility.

Learn Ethereum’s [ETH] Value Prediction 2023-24

Based on the most recent alerts by Glassnode, the quantity of ETH provide final lively 5 to seven years just lately hit a four-month excessive. Much more attention-grabbing was a discovering, which revealed that Ethereum futures contracts’ open curiosity reportedly reached a brand new month-to-month excessive.

📈 #Ethereum $ETH Futures Contracts Open Curiosity simply reached a 1-month excessive of $47,993,283.71 on #Huobi

Earlier 1-month excessive of $47,896,498.52 was noticed on 18 December 2022

View metric:https://t.co/hFZ1PPd8fT pic.twitter.com/Llk60qIbQV

— glassnode alerts (@glassnodealerts) December 19, 2022

The rise within the demand for futures contracts might give technique to a rise within the cryptocurrency’s volatility this week. Nonetheless, these observations don’t essentially point out which course will likely be in favor. Maybe a take a look at a few of ETH’s metrics might present a tough thought of what to anticipate.

Launching a bullish assault?

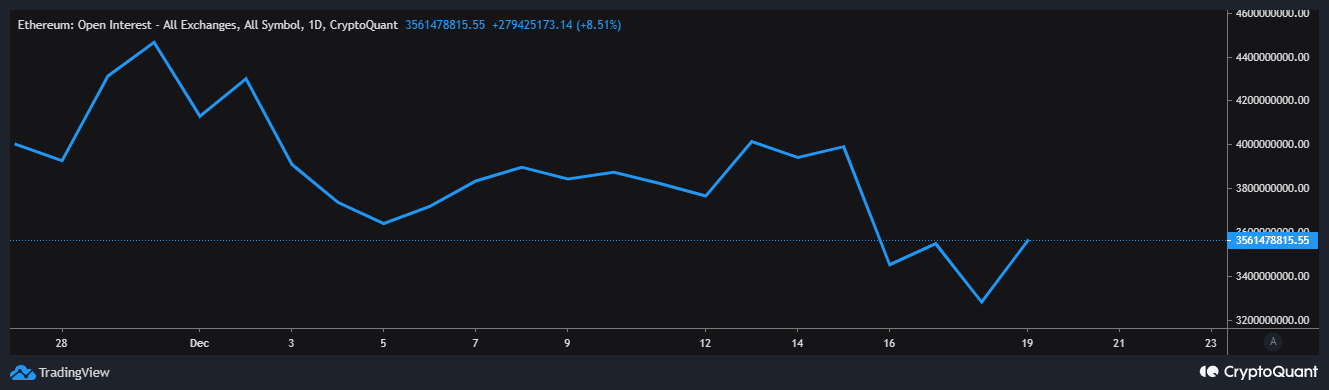

ETH’s open curiosity metric noticed a pointy uptick within the final 24 hours. This confirmed that the demand for the cryptocurrency was recovering.

Supply: CryptoQuant

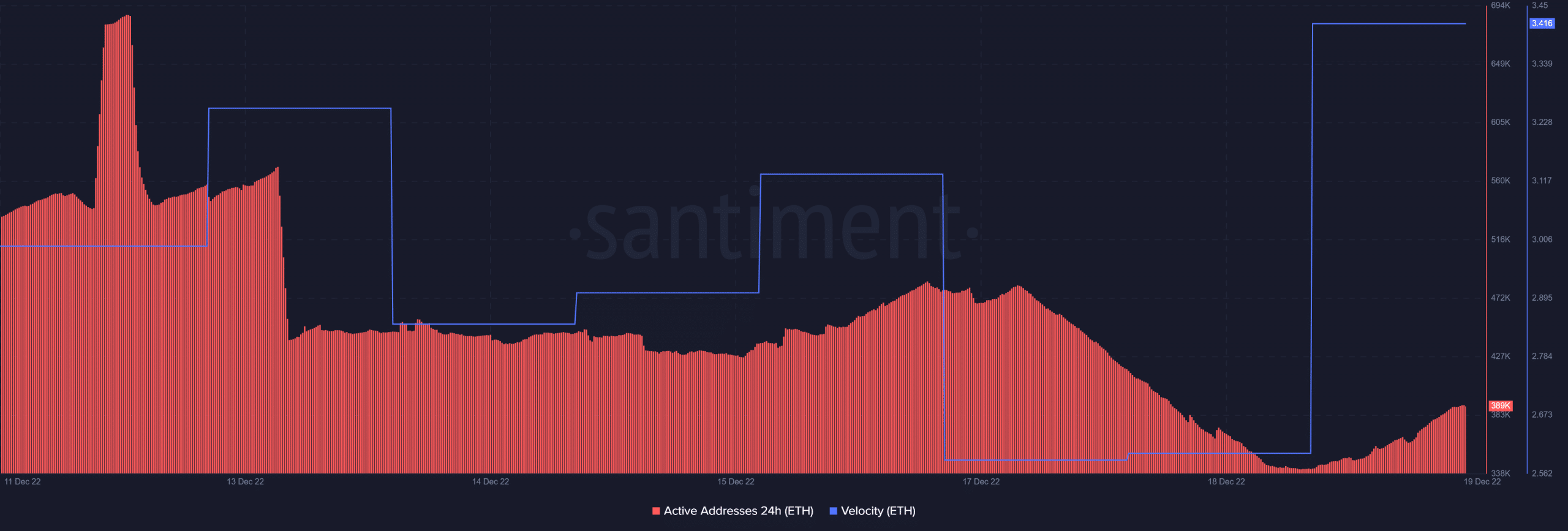

This uptick in open curiosity additionally mirrored a resurgence in tackle exercise. The 24-hour lively addresses metric skilled an uptick within the final 24 hours, confirming that the retail market noticed some exercise. This was additionally accompanied by a pointy uptick in velocity, thus creating the expectation that ETH would possibly uphold greater volatility within the subsequent few days.

Supply: Santiment

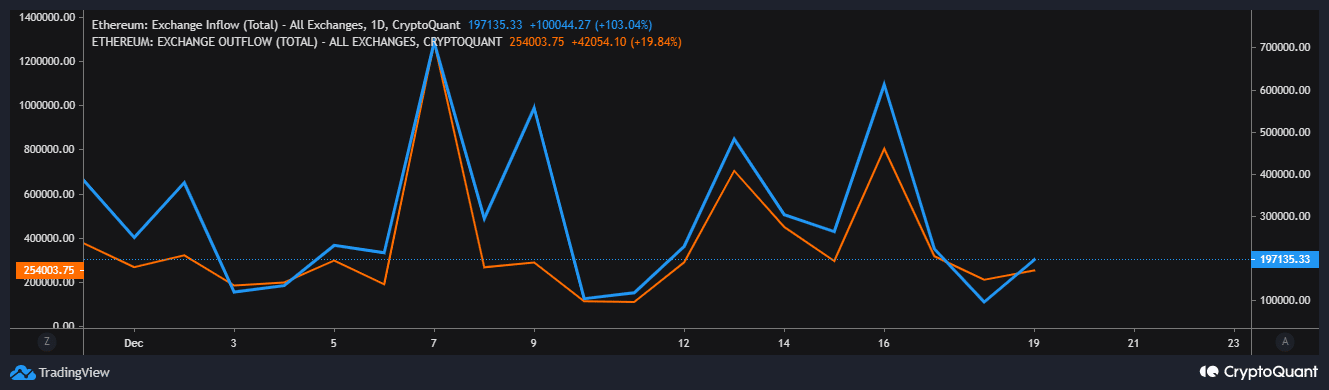

However what was the state of demand for ETH available in the market? A take a look at the coin’s alternate flows revealed that it had greater alternate outflows than inflows within the final 24 hours. Nonetheless, ETH alternate inflows had the next enhance than the variety of alternate outflows.

Supply: CryptoQuant

Whereas these metrics indicated a resurgence of demand, particularly of the bullish type, in addition they revealed that the bears weren’t but carried out with ETH. As of 19 December, its worth motion noticed a drop in bearish momentum within the final three days after the sharp crash it skilled final week.

ETH bulls are placing up a good combat

Maybe the perfect rationalization for the above observations was that the bulls had been trying to make a comeback. This will clarify why the draw back slowed down and misplaced its momentum. Nonetheless, the prevailing bullish power within the final two days was not robust sufficient to lend favor to the bulls.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)