- Ethereum whales are accumulating ETH in important quantities

- Validators present curiosity in Ethereum, regardless of declining income

With all the eye within the crypto-space being directed in direction of the FTX saga, whales and sharks have been accumulating ETH underneath the radar.

Learn Ethereum’s Worth Prediction 2022-2023

A number of fish within the sea

Santiment, a number one crypto-analytics agency, not too long ago tweeted that addresses holding 100 to 100k ETH have been capitalizing on the altcoin’s worth drop. In reality, they’ve been accumulating $ETH massively. The platform additionally revealed that the final time whales collected a lot ETH, there was a worth surge of 50% on the charts.

Now, despite the fact that whales appear to be accumulating Ethereum aggressively, it stays to be seen whether or not retail buyers will observe swimsuit as nicely.

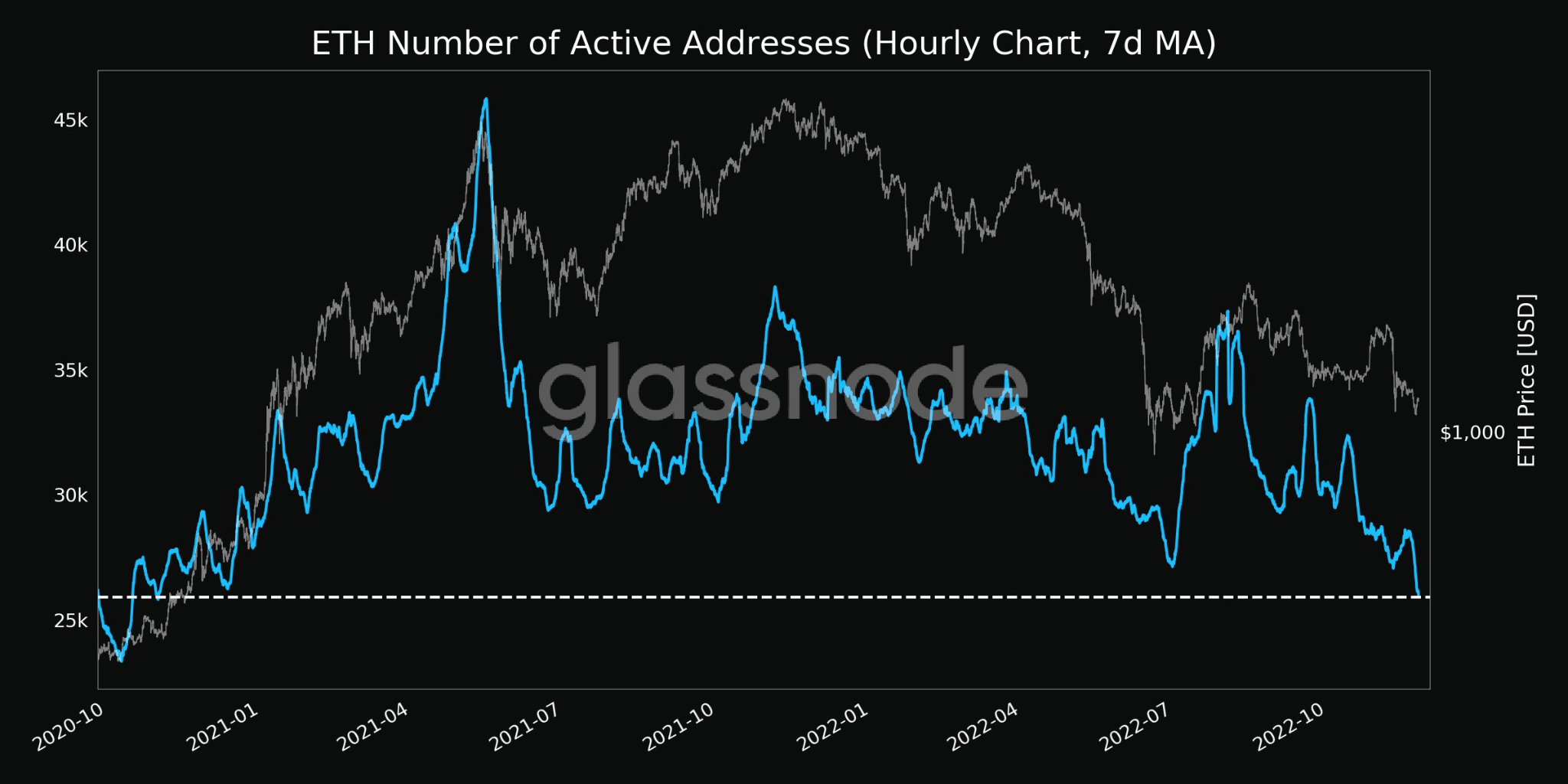

Nevertheless, on the time of writing, lively addresses on Ethereum have been declining. As may be seen, the variety of lively addresses fell dramatically over the previous few months. In reality, based on Glassnode, the variety of lively addresses hit a 2-year low of 25,916.

Together with that, the variety of addresses in loss additionally touched an all-time high. This indicated that most individuals holding Ethereum wouldn’t make a revenue, in the event that they have been to promote their ETH at this cut-off date.

Supply: Glassnode

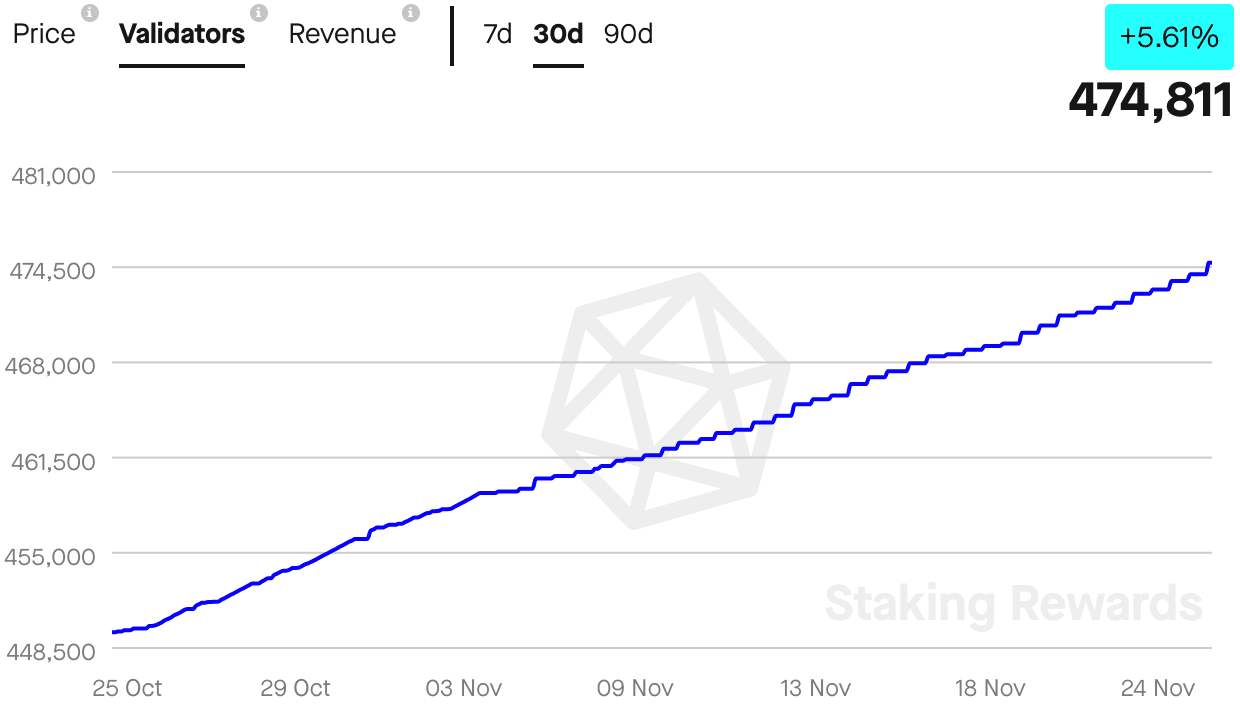

Regardless of the FUD and drop in worth, Ethereum validators have continued to assist Ethereum.

In reality, the variety of validators on the Ethereum community grew by 5.51% during the last 30 days. On the time of writing, there have been greater than 474,000 validators on the community. These validators have continued to indicate religion in Ethereum, regardless of their declining income.

In accordance with Staking Rewards, the income generated by Ethereum validators declined by 5.48% during the last 30 days. It stays to be seen whether or not these validators will proceed to be on the Ethereum community.

Supply: Staking Rewards

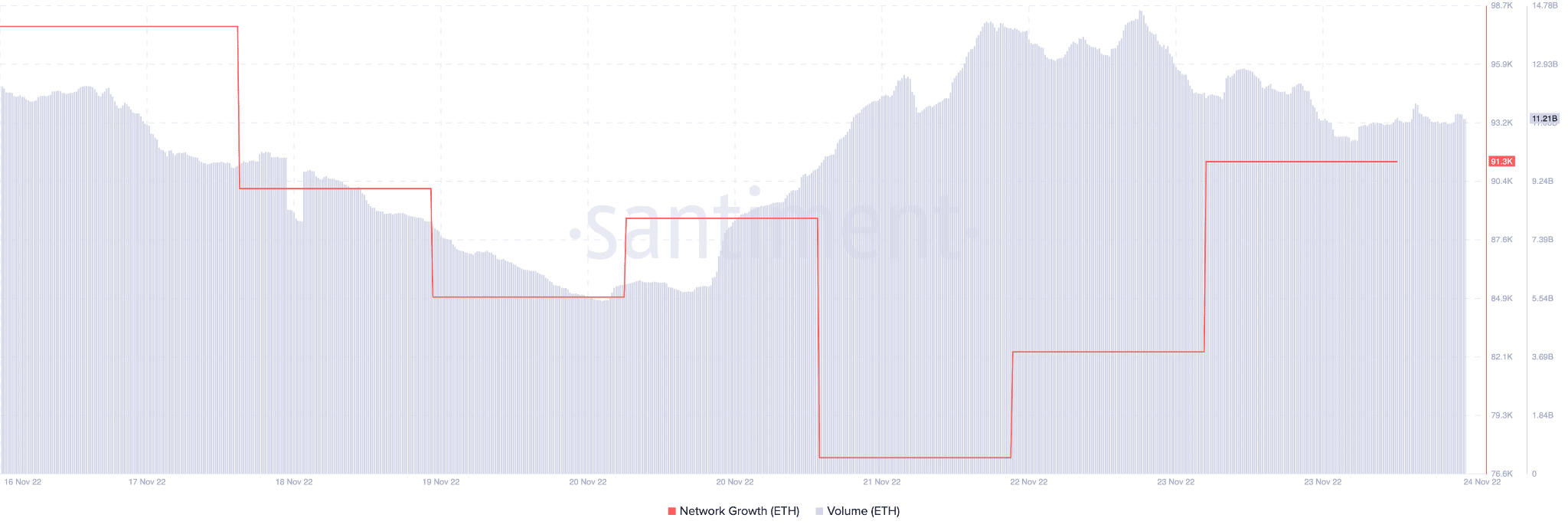

Furthermore, Ethereum’s community development witnessed a spike over the previous few days. This prompt that the variety of new addresses that transferred ETH for the primary time had appreciated over the previous few days.

Together with that, Ethereum additionally recorded an uptick in its quantity. From 5.54 billion on the twentieth of November, its quantity climbed as excessive as 11.27 billion on 24 November.

Supply: Santiment

On the time of writing, ETH was buying and selling at $1200.14, with its market cap appreciating by 3.09% within the final 24 hours.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)

![How sharks, whales are showing interest in Ethereum [ETH] these days](https://cryptonoiz.com/wp-content/uploads/2022/11/pasted-image-0-18-1-1000x600-750x375.png)