Market Knowledge Forecast’s report on the FinTech trade predicts that by the tip of 2026, the market worth of DeFi might be $324 billion.

DeFi or Decentralized Finance in easy phrases talks concerning the democratization of finance within the context of the digital area away from monetary establishments. Since its inception, the continual rise of DeFi has been a recreation changer within the general working of the monetary world.

Synthetic Intelligence or AI has been one other main revolution that has taken the world by storm. From being time-effective to offering automation in varied elements, AI has modified the best way folks suppose and carry out their day by day actions. Bringing the 2 most important revolutions collectively on the identical platform is usually a large step towards sustainability and progress.

DeFiLabs has been an necessary step on this path. Visualizing the utilization of AI within the monetary area, DeFiLabs got here into the limelight. The previous not solely bends AI and DeFi collectively but additionally makes use of AI to dynamically handle the diversified baskets of cryptocurrency belongings.

What’s DeFiLabs?

DefiLabs is among the well-established, fastest-moving Defi-based platforms throughout the DeFi ecosystem. It’s a one-stop, decentralized, non-custodial asset administration platform that aggregates Defi actions in a single place. The platform is useful for customers concerned in staking and buying and selling.

Developed by open-source software program, together with the utilization of AI know-how DeFiLabs brings the monetary limitations of AI-managed funds to DeFi. Thereby, ensuing within the simplification of complicated market navigation. The platform invests within the DeFi trade and actively manages single positions and market threat.

The structure and economics of DeFiLabs allow the administration of portfolios, execution of environment friendly asset allocations, and promote market-making capabilities. All these capabilities are executed to advocate liquidity swimming pools for high-yield returns and predict mannequin asset administration methods.

On the subject of safety, Certik and Coinscope, absolutely audit the platform creating no room for doubts amongst customers buying and selling/staking on the platform. Feeding real-world knowledge to good contracts on the blockchain, DeFiLabs serves as a hyperlink between the unparallel quantity of data alternating between crypto DApps.

Incentivizing crypto holdings with DeFi Staking

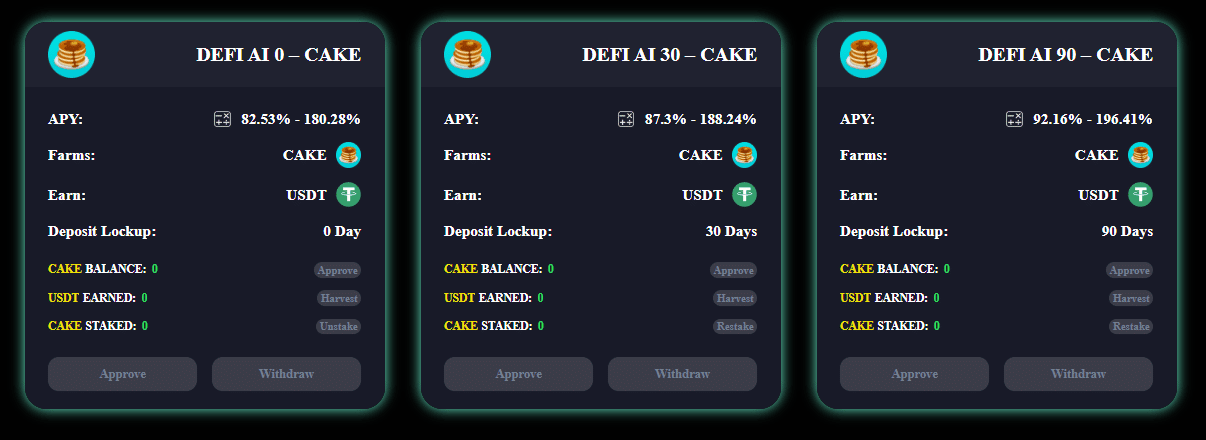

DeFi Staking being one of many hottest traits within the cryptocurrency trade, incentivizes customers to carry on to their crypto holdings. The previous is a safer and fewer dangerous approach of producing passive income in comparison with conventional means. DefiLabs identified for its DeFi Staking makes it simpler for customers to faucet into greater rates of interest in comparison with financial savings accounts and conventional merchandise.

Built-in with AI know-how, DeFiLabs affords customers an AI aggregator Staking platform the place customers are entitled to receiving staking rewards. In easy phrases, DeFi staking is the method of ‘locking’ crypto tokens right into a DeFi good contract to earn extra of these tokens in return. By doing so, customers turn out to be part of the community’s validators.

Therefore for the safety of the protocol, each proof-of-stake blockchain protocol depends on these validators. In return, customers who’ve staked part of their token to safe the community are rewarded for his or her actions. These leads to growing APYs, thereby DeFiLabs at the moment accounting for a complete of 443% APY.

AI portfolio administration

To assist buying and selling, DeFiLabs deploys an AI ecosystem to supply liquidity to the DeFi markets by growing customers’ values and returns. The platform takes into consideration varied AI specialists to supply big advantages to the token holders by performing completely different capabilities within the ecosystem.

- The Portfolio Planner: The planner makes use of on-chain market knowledge and will get predictions on value traits and volatility. This additional helps in planning and constructing long-term funding methods for DefiLabs’ customers inside restricted volumes and threat ranges.

- The Weighting Agent: This AI agent depends on the identical knowledge and predictions indicating short-term weights on the liquidity pool. This helps the Portfolio Balancer to regulate portfolio stock in given short-term dangers.

- The Sentiment Watcher: This function permits customers to observe information feeds, on-line media, and social media chatter about particular DeFi initiatives and general DeFi-related buzz.

- The Technique Evaluator: The evaluator makes use of the identical on-chain knowledge and value development/volatility predictions to guage completely different aggressive methods and the parameters of those methods. It backtests quite a few methods on historic knowledge and recommends the perfect one for present market circumstances to the Portfolio Balancer purposes. These methods specify the easiest way for DefiLabs’ customers to rebalance their stock, deploy good contracts for liquidity provision on the portfolio devices, and execute corresponding trades.

Ultimate phrase

The core values of DeFiLabs make sure that customers have full management over their funds that are locked in good contracts. The simple-to-use interface of the platform makes it simple for customers to expertise clear buying and selling/staking on the platform.

Moreover, the mixing of AI into DeFi opens a gateway for customers to expertise minimal threat and error together with speedy and unbiased decision-making.

Being a community-owned platform, DeFiLabs appears to be like ahead to establishing quite a few long-term partnerships. With the mission to carry extra income to everybody, the platform doesn’t compromise on belief and makes it a extremely dependable and safe buying and selling/staking platform.

To know extra about DeFiLabs, go to the official website or be part of the Telegram channel for all current updates.

Disclaimer: This can be a paid publish and shouldn’t be handled as information/recommendation.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-350x250.jpg)