The Bitcoin value is lingering just below $19,000 on the time of writing, not removed from the native low of $18,300. When the Client Worth Index (CPI) and Producer Worth Index (PPI) information was launched final week, the BTC value plunged to simply that value stage.

Unexpectedly for a lot of, a really fast rebound occurred, catching shorters off guard. With November 02 – when the FED meets once more – in thoughts, the Bitcoin value doesn’t have a lot room to fall beneath that stage in the meanwhile. Furthermore, a take a look at the on-chain suggests one other crash is feasible within the quick time period, though there are optimistic indicators as nicely.

According to CryptoQuant, a bear market sign seems when the realized value of all long-term holders (blue line) goes above the realized value of all cash purchased (crimson line) and when the BTC value falls beneath the realized value of long-term holders and the realized value of all cash.

The evaluation concludes that the Bitcoin value has been in a bear marketplace for 124 days. On this respect, the drop from $6,000 to $3,000 is corresponding to the worth decline from $30,000 to $18.000, as the proportion decline within the final bear market from $6,000 to $3,000 was 50%.

That being mentioned, the underside could not have been seen but:

The drop from $30.7k to $18.2k was 41%. A 50% drop from $30.7k would put BTC at $15k (-18% from the present value). Much like the $14.7k delta value.

Contradictory On-Chain Information For Bitcoin

With Santiment, one other main on-chain evaluation service acknowledged that the Bitcoin market must ideally see accumulation in the meanwhile, whereas small merchants stay bearish and unfold doom and gloom.

Nevertheless, contradictory information is displaying up on this regard. Thus, Bitcoin’s small to mid-sized addresses (with 0.1 to 10 BTC) have just lately reached an all-time excessive of 15.9% of accessible provide. On the similar time, whales with 100 to 10,000 BTC have recorded a 3-year low of 45.6% of provide.

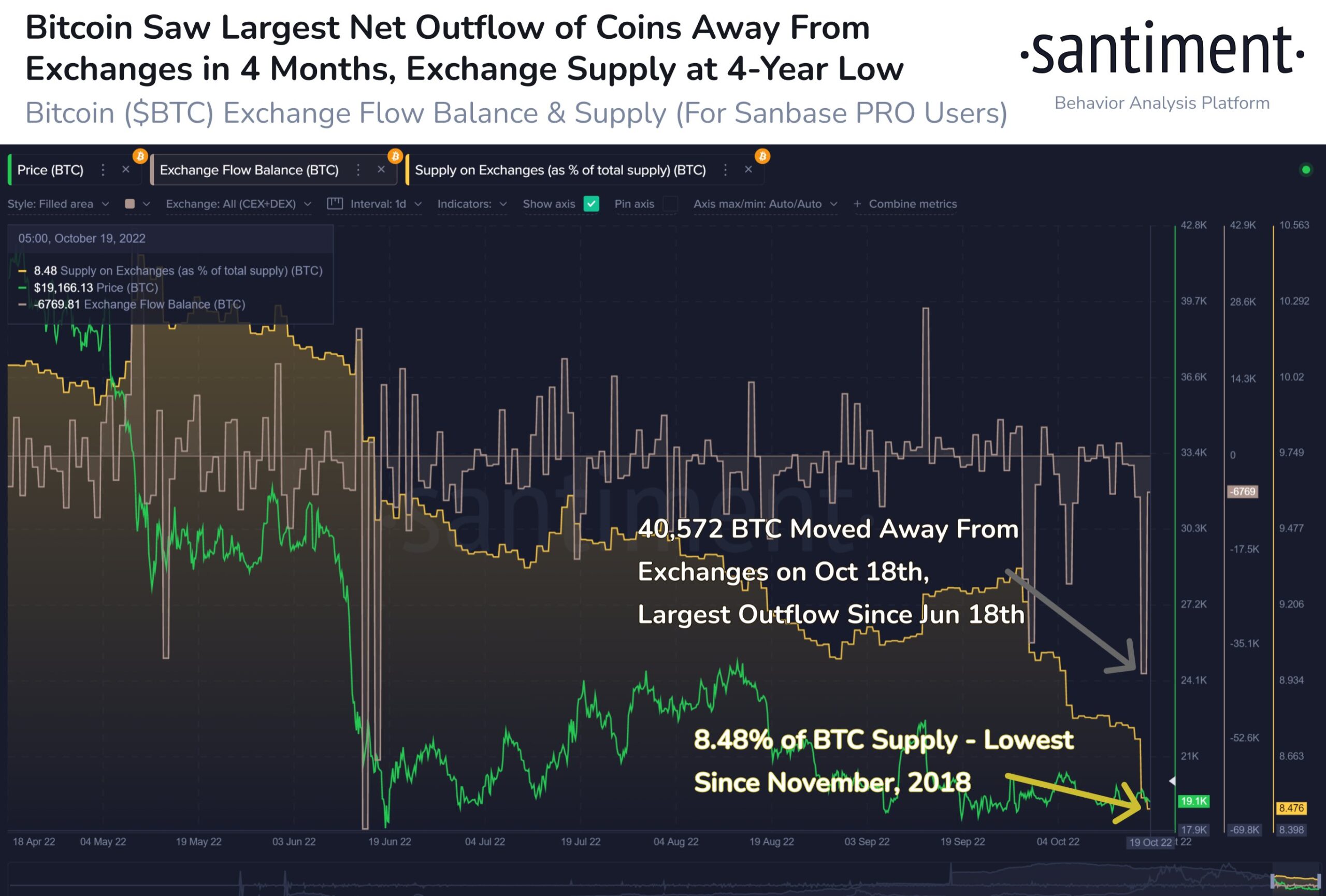

On the bullish aspect, Bitcoin skilled a large outflow of cash from exchanges on October 18. Santiment recorded the biggest each day quantity in 4 months, amounting to 40,572 BTC. With this, the availability of cash on all exchanges has dropped to eight.48%. Which means the chance of a future sell-off has decreased at the least considerably.

Bullish information can also be reported by the third main on-chain information supplier Glassnode. Bitcoin provide which has not moved within the final 6 months is approaching an all-time low. It presently stands at 18.12% of circulating provide or about 3.485 million BTC. Glassnode writes:

Traditionally, very low volumes of cell provide usually happen after extended bear markets.

Jim Bianco, President of Bianco Analysis LLC, just lately quoted an outdated dealer’s adage, “By no means quick a boring market,” which can apply greater than ever to the Bitcoin market.

In keeping with his evaluation, the realized volatility that means the backwardation or precise volatility is at a 2-year low and is recording one of many lowest ranges of all time.

Markets backside on apathy, not pleasure. BTC and ETH have apathy. The S&P 500 is almost the alternative, as costs transfer round like a online game. This may additionally be one other signal of the TradFi/Crypto tight relationship breaking. If that’s the case, that is long-run bullish for crypto.

Diverging volatility might due to this fact be an indication of this shift and finally set off a long-term optimistic pattern.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)