For the longest stretch of days for the reason that cryptocurrency market was shaken by unrest in July, Bitcoin has dropped under US$20,000 for a sixth straight buying and selling session.

On Thursday, the worth of the most important cryptocurrency dropped as a lot as 3.1% to $19,577.

Bitcoin In Free Fall

The most important cryptocurrency by market capitalization has been in free fall for the earlier ten days as issues over Wednesday’s FOMC minutes drove its worth under $20,000. Regardless of the current decline, traders appear to be rising their Bitcoin purchases, and sure key on-chain information point out that the value could also be on the brink of emerge from its most up-to-date low.

Market Analyst Jim Wyckoff foresaw the rise in volatility and cautioned in his morning Bitcoin transient that “quieter sideways buying and selling continues, however in all probability not for for much longer. Historical past demonstrates that the monetary markets can expertise volatility in September.

BTC/USD trades at $20k. Supply: TradingView

Wyckoff predicted that it would final for a while so long as bears proceed to outnumber bullish merchants.

“Within the quick future, anticipate elevated cryptocurrency volatility. To interrupt the value decline that’s nonetheless seen on the every day chart for bitcoin, albeit narrowly, bulls have to exhibit larger power, in accordance with Wyckoff.

Bitcoin common funding charges. Supply: Santiment

The cryptocurrency analytics firm Santiment, which printed the next chart displaying the rise in BTC common funding charges, revealed that the sentiment in opposition to Bitcoin continues to be unfavorable.

Concern Overtakes Hope

Lower than US$1 trillion, or roughly a 3rd of its peak market worth reached in November, is now the scale of the cryptocurrency trade. Coin values have been shaken midyear by the collapse of the Terra ecosystem, the demise of Three Arrows Capital, the chapter of dealer Voyager, and the failure of lender Celsius after coming off the highs amid a normal improve in danger aversion.

Stephane Ouellette, chief govt of FRNT Monetary Inc. stated:

“There may be lots of concern that if we make new lows on BTC (as a proxy for the market), there can be one other wave of crypto firm defaults.”

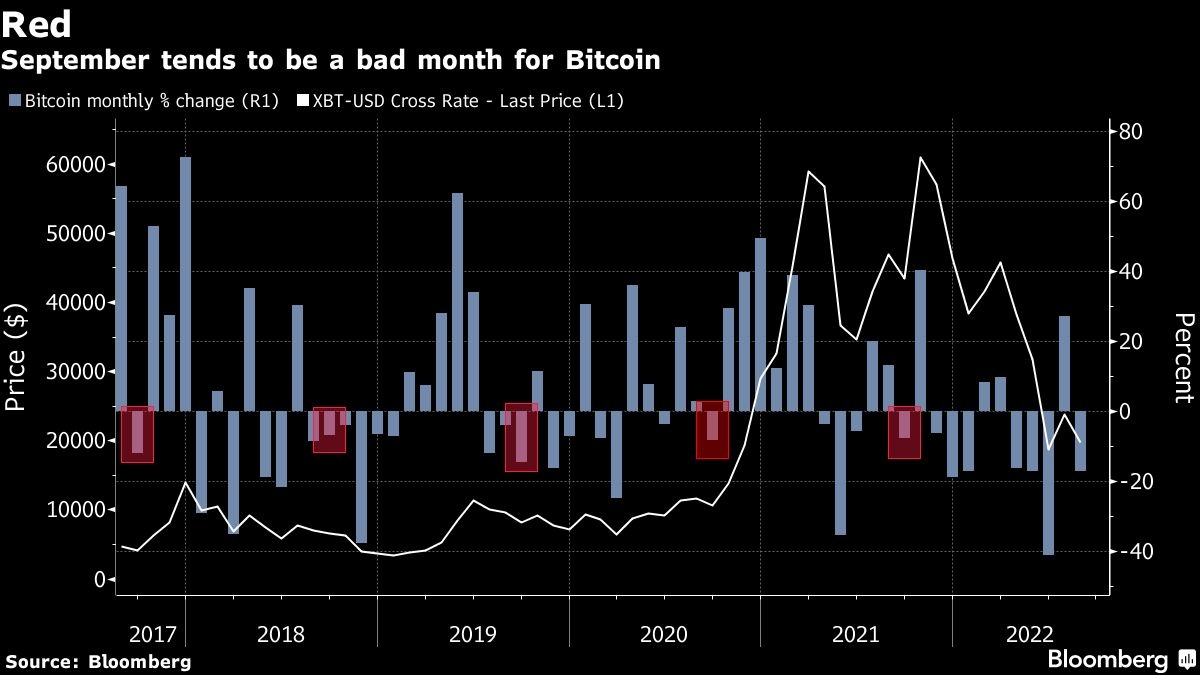

Supply: Bloomberg

The autumn on September’s first day is unfavorable for the bellwether forex. Since 2017, each September has seen a decline within the worth of Bitcoin, making it historically one of many worst months of the yr. In line with Bespoke Funding Group, over the previous 5 years, the month-to-month decline within the worth of Bitcoin has averaged 8.5%.

The general cryptocurrency market cap now stands at $967 billion, and Bitcoin’s dominance fee is 39%.

Featured picture from UnSplash and chart from TradingView.com, Bloomberg, and Santiment

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)