Knowledge reveals round 300k in ETHUSD lengthy positions have been closed on the Bitfinex Ethereum futures market, one thing that might present impedance to the newest rally.

Ethereum Lengthy Positions Have Dropped By Extra Than 300k Throughout The Final Few Days On Bitfinex

As identified by an analyst in a CryptoQuant post, the previous knowledge of the ETHUSD lengthy positions on the crypto alternate Bitfinex would counsel the present sample might show to be bearish for the worth of the coin.

The related metric right here is the full variety of Ethereum lengthy positions (ETHUSD pair) at the moment open on the Bitfinex alternate.

When the worth of the indicator is excessive, it means a bullish sentiment is extra dominant amongst buyers on the platform proper now.

However, low values may counsel whales on the alternate at the moment don’t consider the coin’s value goes to go up quickly.

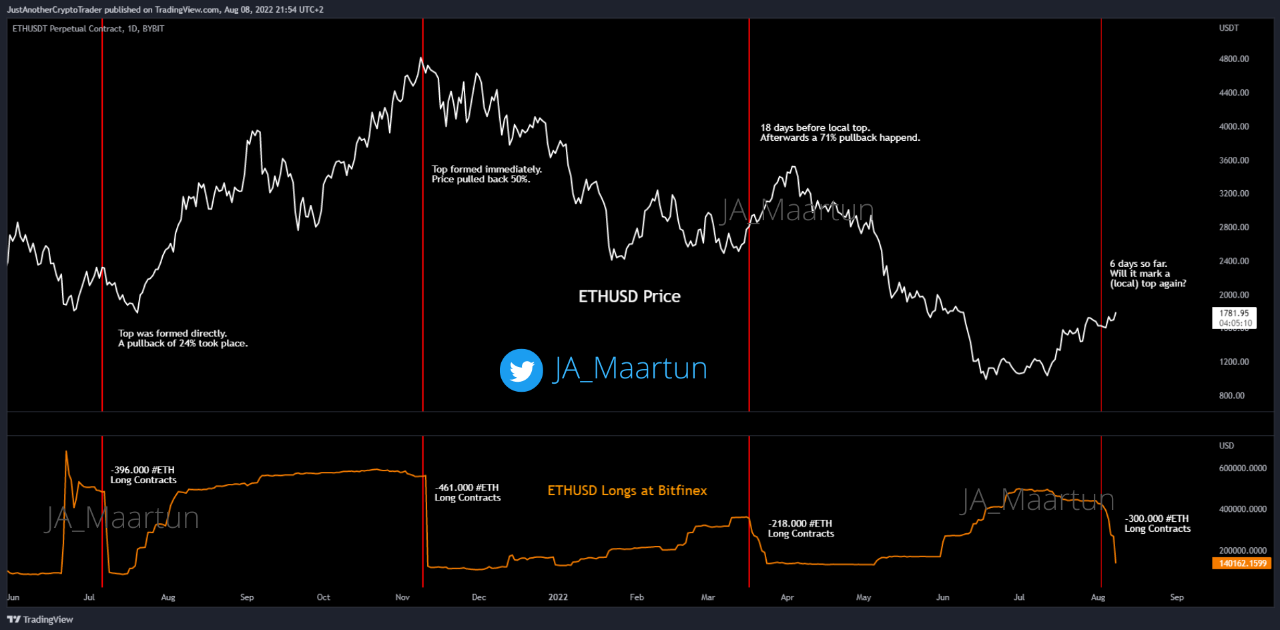

Now, here’s a chart that reveals the development within the ETHUSD lengthy positions on Bitfinex throughout the previous yr:

The worth of the metric appears to have sharply declined in latest days | Supply: CryptoQuant

As you may see within the above graph, the quant from the submit has marked the related factors of development for the ETHUSD Bitfinex longs throughout the interval.

It seems like at any time when Ethereum lengthy positions on the platform have noticed a plunge down, so has the worth of the crypto.

This development has taken place both instantly after the drawdown on the indicator, or some days following the actual fact.

The longest hole between the value plunge and the metric’s decline up to now yr was again in March, the place the crypto continued to rally for 18 days earlier than forming the native prime.

Prior to now week, the Ethereum longs on Bitfinex have as soon as once more seen a pointy downwards transfer, amounting to round 300k such positions being closed.

Thus far, the coin has continued to maintain going up for round 6 days now. If the previous sample is something to go by, then the present development might imply ETH may observe an area prime forming within the subsequent 12 days.

ETHUSD

On the time of writing, Ethereum’s value floats round $1.7k, up 8% within the final seven days. Over the previous month, the crypto has gained 40% in worth.

The under chart reveals the development within the value of the coin during the last 5 days.

Seems to be like the value of the coin has been largely trending sideways throughout the previous couple of days | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)