Abstract:

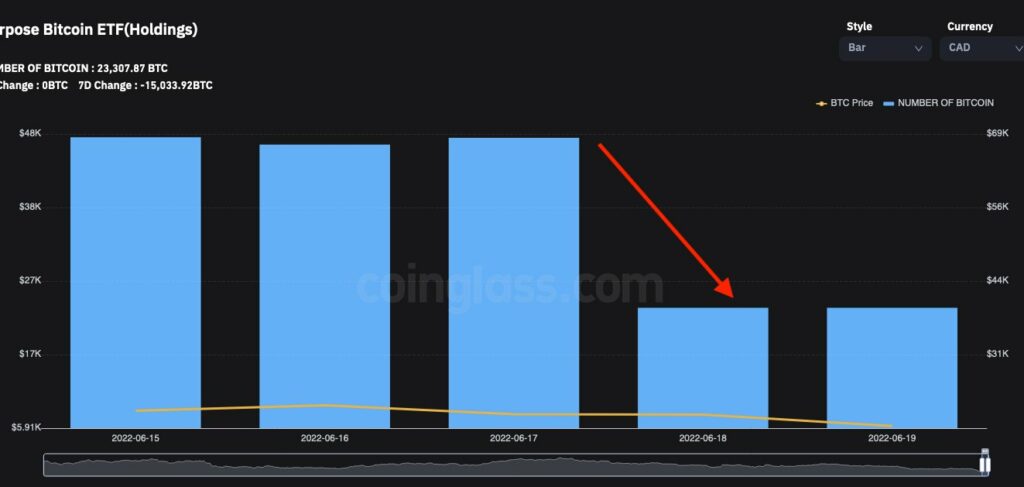

- Arthur Hayes has highlighted that the Goal Bitcoin ETF offloaded 24.5k BTC into the markets on Friday’s shut.

- Bitcoin went on to drop to the native low of $17,600 as a result of promoting strain that would have been a run to set off cease losses.

- The Bitcoin and crypto markets have since rallied, with BTC buying and selling above $20k.

The co-founder and former CEO of Bitmex, Arthur Hayes, has shared an interesting observation concerning what may need induced Bitcoin’s dump beneath $20k to an area low across the $17,600 worth degree.

Goal Bitcoin ETF Puked 24k BTC on Friday.

In response to Mr. Hayes, the Goal Bitcoin ETF offloaded 24,500 BTC into the American shut on Friday, resulting in a number of promoting strain that would have been a run to set off cease losses. He shared his evaluation of the risky weekend by way of the next assertion and accompanying charts.

BTCC – Goal ETF puked 24,500 $BTC into the North American Friday shut. I’m unsure how they execute redemptions however that’s a number of bodily BTC to promote in a small timeframe.

Over the weekend, whereas the fiat rails are closed, $BTC dropped to a low of $17,600 down nearly 20% from Friday on good quantity. Smells like a pressured vendor triggered a run on stops.

Not a Assure that the Bitcoin and Crypto Turmoil is Over.

Mr. Hayes shared that after the Bitcoin was dumped, the crypto markets quickly rallied in low volumes. Bitcoin has regained the essential $20k help degree, and Ethereum has reclaimed $1k.

He additionally added that given the clearly ‘poor state of danger administration by crypto lenders and over-generous lending phrases,’ crypto merchants ought to ‘anticipate extra pockets of pressured promoting of BTC and ETH because the market figures out who’s swimming bare.’

Arthur Hayes concluded that the promoting within the Bitcoin and crypto markets won’t be over. Nonetheless, merchants expert at ‘knife catching’ may gain advantage from ‘extra alternatives to purchase coin from those that should whack each bid irrespective of the value.’

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)