On-chain knowledge suggests Bitcoin long-term holders have began to capitulate not too long ago because the sharp value drop causes panic available in the market.

Bitcoin CDD Influx Indicator Jumps Up, Displaying Lengthy-Time period Holders Have Been Promoting

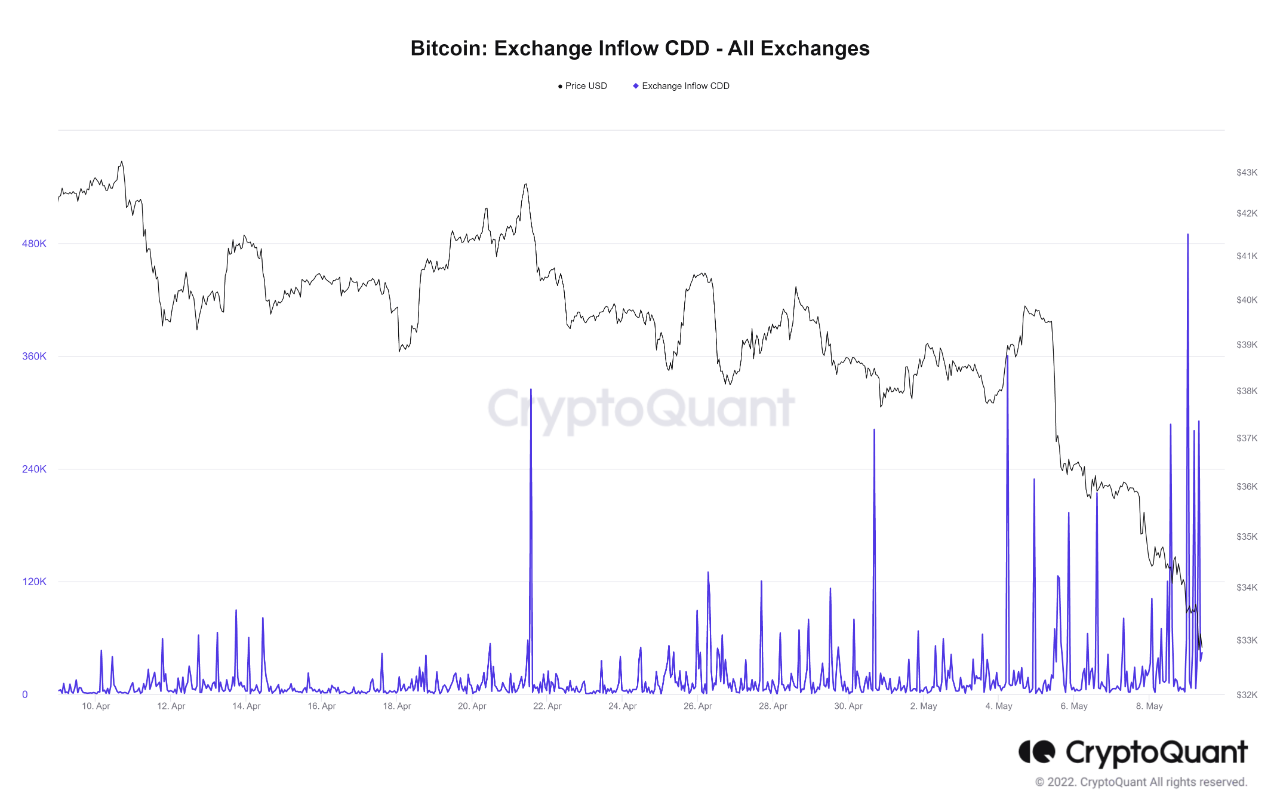

As identified by a CryptoQuant post, the latest value drop has pushed long-term holders in direction of promoting their BTC.

“Coin days” are the variety of days a Bitcoin has remained dormant for. An instance: if 1 BTC doesn’t transfer for five days, it accumulates 5 coin days.

When such a coin could be transferred or moved, its coin days could be “destroyed” because the quantity will reset again to zero.

Associated Studying | Bitcoin Slips Under $33k As Alternate Inflows Attain Highest Worth Since July 2021

The “coin days destroyed” (CDD) metric naturally measures what number of of those coin days are being destroyed in the whole market at any given time.

A modification of this indicator, referred to as the “Bitcoin alternate influx CDD,” tells us about solely these coin days that had been destroyed by a switch to exchanges.

A excessive worth of the influx CDD usually means that long-term holders (who accumulate numerous coin days) are transferring their cash to exchanges.

Traders normally switch their Bitcoin to exchanges for promoting functions, so LTHs transferring numerous their cash could be bearish for the worth of the crypto.

Now, here’s a chart that reveals the pattern within the BTC influx CDD over the previous month:

The worth of the indicator appears to have spiked up not too long ago | Supply: CryptoQuant

As you may see within the above graph, the Bitcoin alternate influx CDD has noticed some excessive values over the previous couple of days.

This reveals that long-term holders have been promoting amid the latest panic available in the market as a result of value drop from $38k to under $30k.

Associated Studying | Terra Beats Tesla As Second-Largest Company Bitcoin Holder After $1.5B Buy

The particularly massive spikes within the final two days counsel LTHs might have began to undergo a section of capitulation.

Since LTHs normally make up the Bitcoin cohort that’s the least prone to promote, capitulation from them is a detrimental signal for the worth of the coin.

BTC Value

On the time of writing, Bitcoin’s value floats round $31.6k, down 18% within the final seven days. Over the previous month, the crypto has misplaced 26% in worth.

The under chart reveals the pattern within the value of the coin over the past 5 days.

Appears like the worth of BTC has noticed a plunge prior to now few days | Supply: BTCUSD on TradingView

Bitcoin’s drop has continued at the moment because the crypto briefly touched under $30k for the primary time since July of final yr, earlier than rebounding again to the present stage.

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)