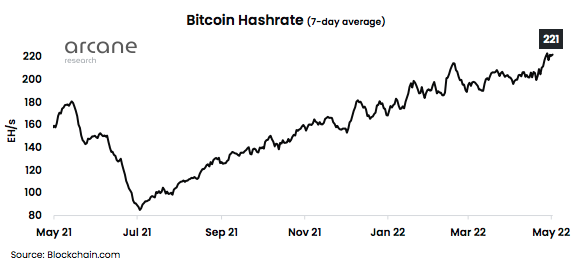

As Bitcoin jumped to $40k within the day following Federal Reserve’s increase hike by half some extent, one other quantity on the rise is its hash price, which hit an all-time excessive of 221 EH/s.

Bitcoin, Hash Price, And Worth

The Hash Price is the Bitcoin community’s measuring unit of the computational energy and pace used to hold on the mathematical operations that verify and course of transactions on the blockchain. Because of this, the Hash Price can mirror the worldwide exercise of bitcoin mining, growing or lowering aspect by aspect.

The value of Bitcoin and the measure of the Hash Price are believed to be associated. The upper the Hash Price, the more healthy and safer the community is, and this will result in a rise in value. Nonetheless, this isn’t a assure as a result of macroeconomic uncertainty is a crucial issue that might dominate the way forward for its buying and selling worth.

Additionally, many miners allege that the worth of Bitcoin has an influence on the Hash Price and never the opposite manner round because the miners work across the community –becoming a member of or not– relying on the second’s profitability.

Hash Price And Problem Going Up At The Identical Time

Only one week in the past, Bitcoin issue hit an all-time excessive of 29.79 trillion after reaching block peak 733,824. As the newest Arcane Analysis weekly report notes, the algorithm did this issue adjustment to be able to decrease the block manufacturing to the specified degree, and now it has by no means been as tough to mine bitcoin.

The issue was anticipated to drop 0.07% round subsequent week through the subsequent adjustment. Nonetheless, the identical Arcane report notes that this enhance in issue has not been an impediment to an increase within the new hashrate coming on-line. Which means that the subsequent adjustment may moderately flip into one other enhance, “pushing the problem even additional upwards.”

Though March and April had been gradual months for the Bitcoin Hash Price, it has now accelerated its tempo and risen to an all-time excessive of 221 EH/s.

Associated Studying | Bitcoin Hashrate Swells 15% Since Final Week As Analysts Anticipate Mining Problem To Improve

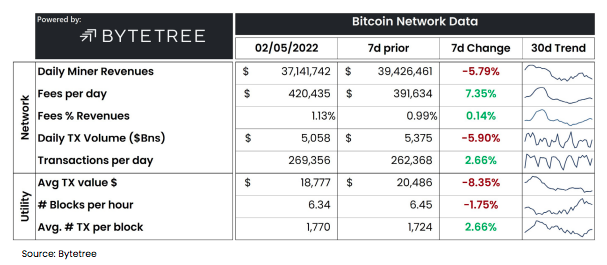

The specified degree of block manufacturing is 6 blocks per hour, however the surge in Hash Price every week in the past was a speedy block manufacturing price of 6.45 blocks per hour.

The Arcane Analysis knowledge additionally stories a 7% enhance in Bitcoin’s each day transaction charges, going from $391,634 to $420,435 in every week. Ethereum, nevertheless, nonetheless takes the lead within the excessive each day transaction charges area with an all-time excessive of $231 million final weekend, two occasions the previous all-time excessive of $117 million.

This occurred on account of Yuga Labs’ minting of 55,000 NFTs, which demanded a large amount of fuel given the exercise of patrons elevated. Ethereum’s scalability downside outshines Bitcoin’s 7% surge in each day charges.

This additionally highlights the upper earnings of Ether miners in comparison with Bitcoin’s for over a yr.

“Bitcoin transaction charges have been minuscule for the reason that summer time of 2021, solely making up round 1% of miner revenues, whereas the remaining comes from the block subsidy,” Arcane Analysis explains, including that Ether miners discover increased profitability due to the elevated fuel charges, though their earnings are additionally extra unstable.

Associated Studying | Bitcoin May See 10% Soar, As Volatility Drops To 18-Month Low

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)