Abstract:

- 30,000 BTC has flowed out of the Coinbase crypto change

- This quantity could possibly be an indication that institutional buyers are as soon as once more involved in Bitcoin

- President Biden’s govt order on digital property could possibly be a motive for the renewed curiosity because it didn’t create any vital hurdles for Bitcoin buyers

- The USA ranks third amongst crypto-friendly nations

30,000 Bitcoin has flowed out of the Coinbase crypto change within the final 24 hours.

This occasion was captured and highlighted by the CEO of CryptoQuant, Ki Younger Ju, who additionally floated the idea that the motion of 30k Bitcoin could possibly be the results of institutional shopping for on account of President Biden’s govt order outlining the federal government’s strategy to digital property.

In accordance with Mr. Ju, the chief order ‘didn’t create any hurdle’ for the acknowledged institutional buyers.

30k $BTC flowed out from Coinbase at this time.

Institutional buys may be the massive narrative once more as a result of the Govt Order didn’t create any hurdle.

h/t @burak_tamac

Reside Chart 👇https://t.co/3ZifmxFo1j pic.twitter.com/KjA7OpefMd

— Ki Younger Ju 주기영 (@ki_young_ju) April 15, 2022

$40k Per Bitcoin Sounds Low cost for Whales

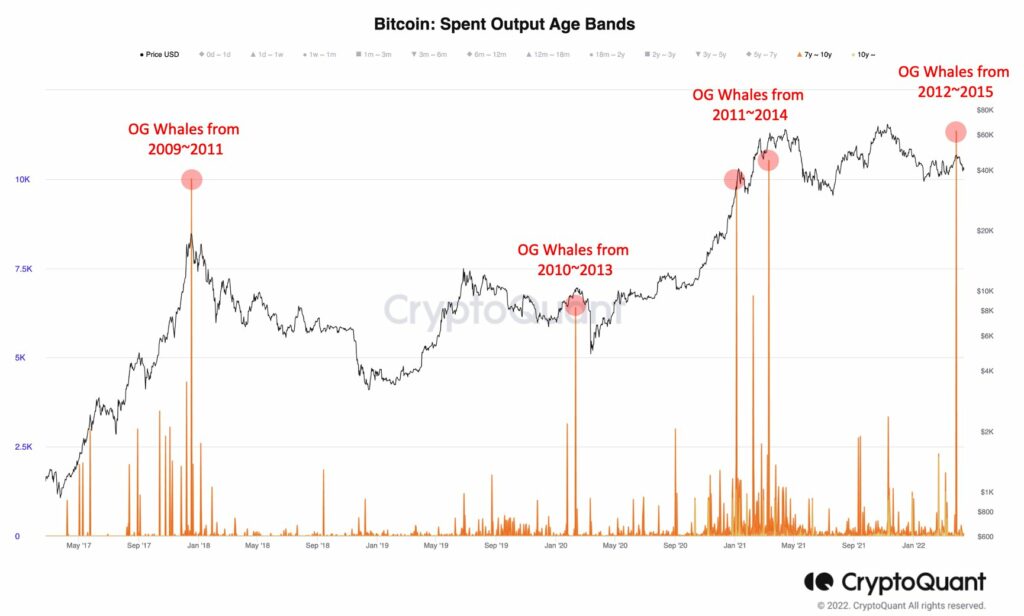

In another analysis shared on Twitter, Mr. Ju speculated that Bitcoin whales bought a part of their holdings when BTC hit $47k. The identical whales at the moment are accumulating at $40k as the worth of Bitcoin appears low-cost. He additional shared the next chart demonstrating the promoting conduct of whales through the years and at completely different value areas.

The USA Ranks Third Amongst Crypto-Pleasant Nations

Circling again to why institutional buyers may be warming as much as Bitcoin, the US is now ranked third amongst crypto-friendly nations. That is partly as a result of President Biden and his administration searching for for higher understanding and regulation of the crypto sector. The aforementioned executive order by President Biden requires measures addressing the next relating to digital property.

- Safety of US clients, buyers, and companies

- Safety of the US and world monetary stability and mitigation of systemic threat

- The mitigation of illicit finance and nationwide safety dangers posed by the unlawful use of digital property

- Promotion of US management in expertise and financial competitiveness to bolster US management within the world monetary system

- Promotion of equitable entry to secure and reasonably priced monetary providers

- Supporting expertise advances and making certain accountable growth and use of digital property

- Exploration of a US Central Financial institution Digital Foreign money

Moreover, based on a report by Blockworks, the US is now ranked first in mining because the nation now controls 35% of the whole Bitcoin hash price forward of Kazakhastan.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)